MicroStrategy Stock Could Compete With Spot Bitcoin ETFs

The world’s largest corporate holder of Bitcoin, MicroStrategy, may be angling to compete with the recently launched bevy of Bitcoin ETFs. In a recent webinar, company co-founder Michael Saylor said the firm was pivoting to a Bitcoin development strategy.

The move could be a way for the firm to compete with investors in the arena of exchange-traded funds. But how do the two stack up?

MicroStrategy Becoming BTC Development Company

In its fourth-quarter earnings webinar on February 6, Saylor said

“We view ourselves as a Bitcoin development company. That means we’re going to do everything we can to grow the Bitcoin network.”

He also said the firm will acquire more BTC and do everything it can to benefit the shareholders.

The slide Saylor was commenting on gave a comparison between MicroStrategy and spot Bitcoin exchange-traded products.

It offered four “unique strengths” comparing company structure, noting that it was an operating company with active control over capital structure and no management fees. Comparatively, spot ETFs were operated with a trust company that has limited control and management fees.

The ability to develop software, generate cash from operations, and leverage capital markets were the other three traits that MicroStrategy has and spot ETFs lack.

Read more: Bitcoin Price Prediction 2024/2025/2030

On February 8, ETF Store President Nate Geraci observed:

“MicroStrategy attempting to position as a superior alternative to spot bitcoin ETFs”

He added that there were “meaningfully different risks involved” which were not outlined. He also mentioned that MicroStrategy stock was down 20% year-to-date while Bitcoin had gained 4%.

MSTR vs. BTC ETFs

Nevertheless, MSTR stock has performed well over the past 12 months, gaining 88%. It posted a yearly high of $685 on January 2 but has cooled off since.

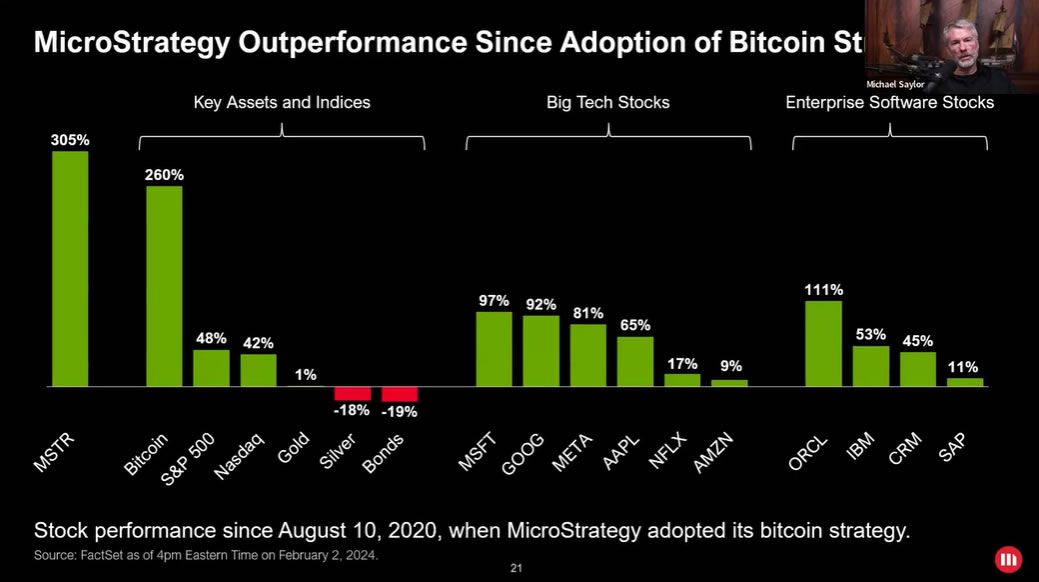

However, since the firm adopted its Bitcoin strategy in 2020, share prices have outperformed US stock indexes, commodities, and even crypto markets themselves.

Spot Bitcoin ETFs are still in their infancy, having only traded for four weeks. Nevertheless, aside from Grayscale, it acquired 187,000 BTC in that period and is close to eclipsing Microstategy’s holdings of 190,000 coins.

Bitcoin ETFs are expected to perform well in 2024 as the crypto market enters a bull phase catalyzed by the BTC halving event in April.

However, that is also good news for MicroStrategy, which is already up 41.6% on its total BTC purchases, according to Saylor Tracker.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.