A flat month for miners after a volatile April

April was a month filled with significant activity and volatility for Bitcoin miners. Most of the month was spent anticipating Bitcoin’s halving and the launch of Runes, with many analysts and market experts warning about the outsized impact they could have on the mining sector.

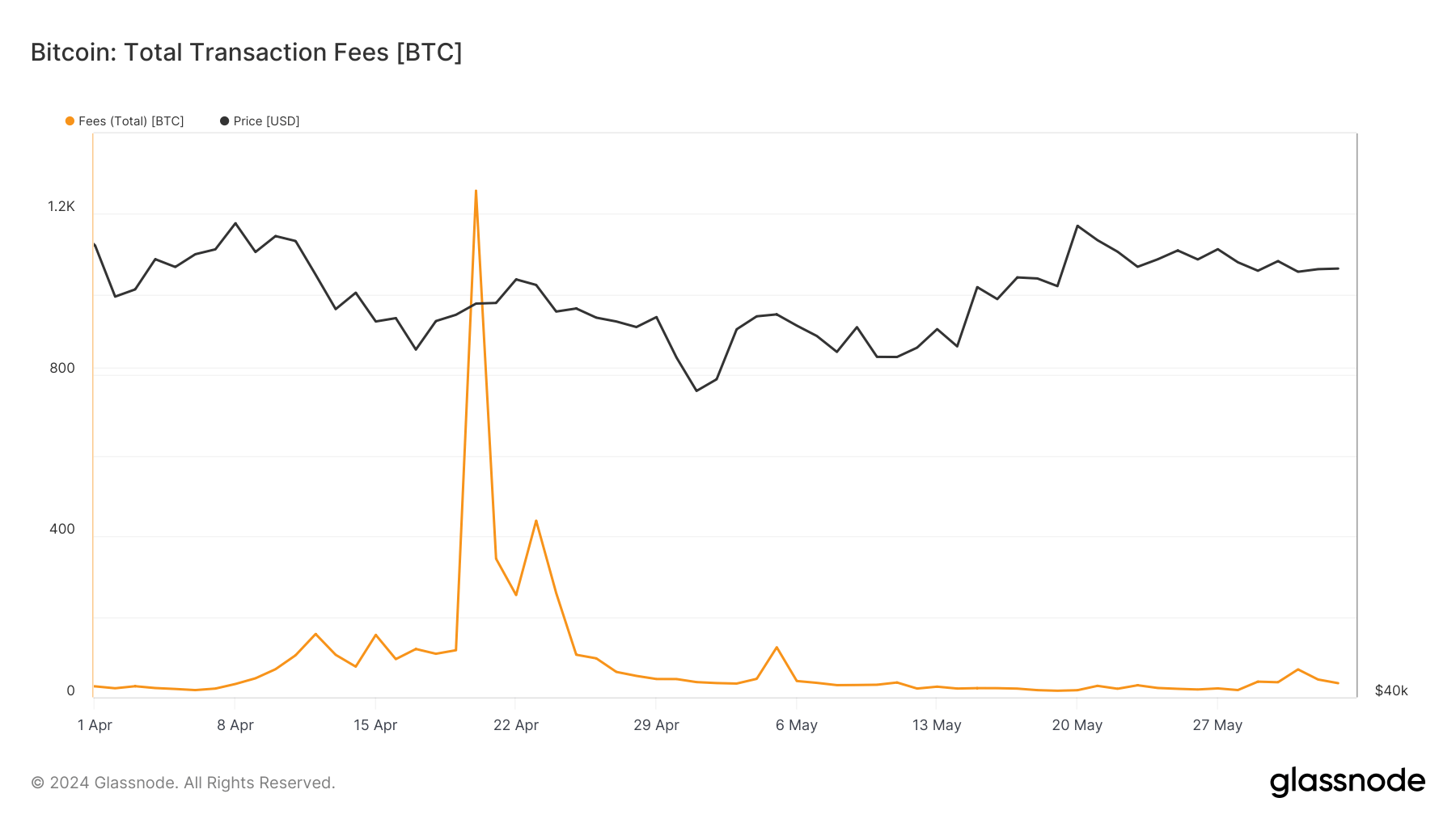

As expected, the combination of the halving and Runes propelled transaction fees and miner revenues to unprecedented heights. A total of 1,257 BTC in fees was paid to miners, bringing their total revenue from fees to 75.44%.

Come May, the mining industry entered a calm and uneventful period. Data from Glassnode showed stability across multiple miner metrics despite the broader market experiencing significant volatility.

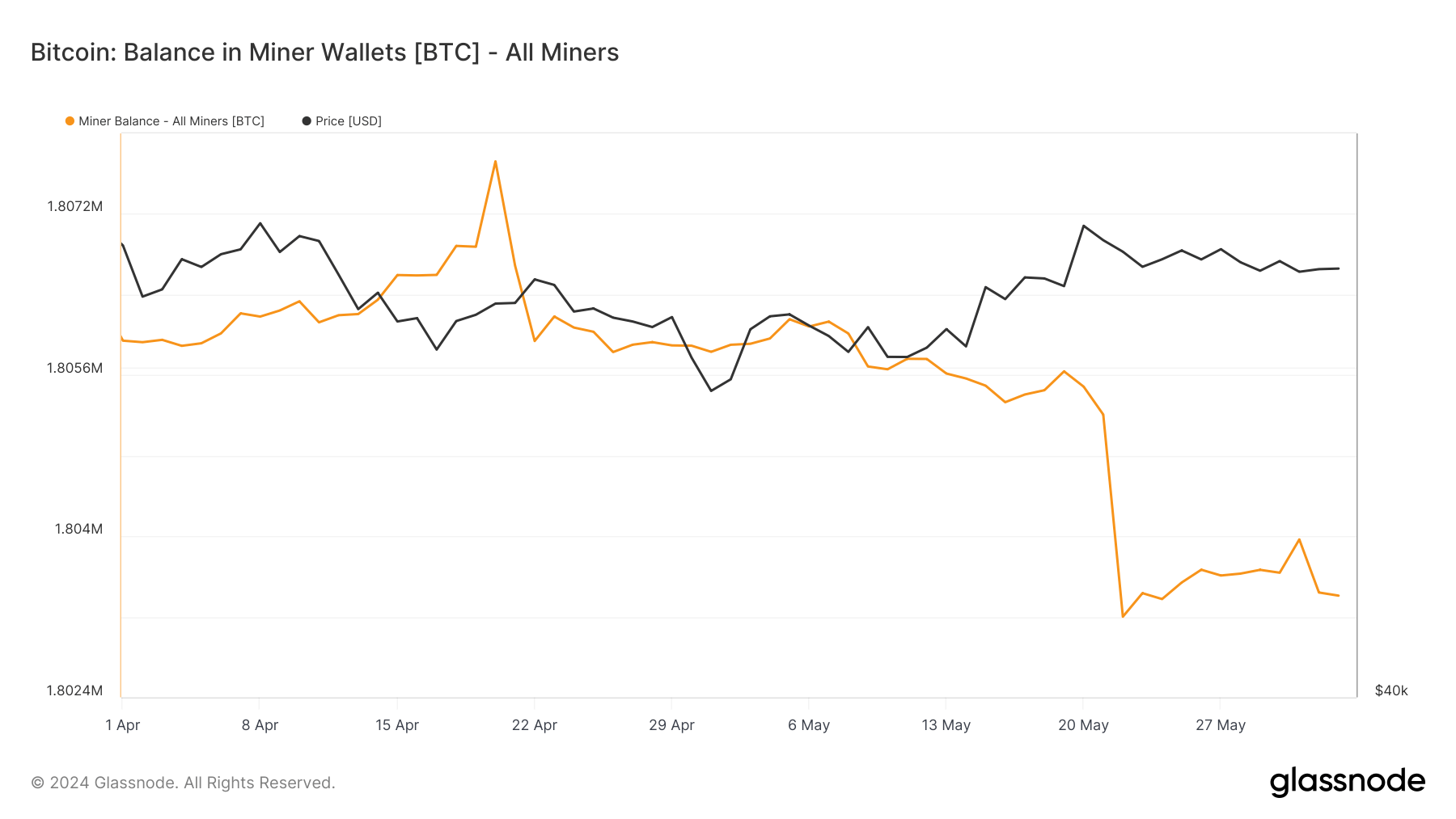

The amount of BTC held in miner wallets saw a vertical spike on April 20, passing 1.807 million BTC. However, this spike was short-lived as miners offloaded much of their newly received profit. Balances reverted to 1.805 million BTC by the end of April, remaining stable throughout May. We saw a slight decrease to 1.803 million BTC by June 3. This balance stability shows a period of equilibrium and reduced activity compared to April. It indicates that miners were neither aggressively selling their holdings nor significantly accumulating new coins, preferring instead to maintain their positions and only cover operating costs.

Transaction fees, a critical indicator of miner revenue and network activity, also reflected this shift. The explosive fee increase to 1,257.71 BTC on April 20 was short-lived, dropping to 253.93 BTC by April 22 and further declining to a mere 16.35 BTC by the second half of May. By June 2, fees had risen slightly to 35.13 BTC, but this was still a far cry from the peaks seen in April. This fee reduction can largely be attributed to the waning attention for Runes and an overall decrease in network congestion and transaction volumes.

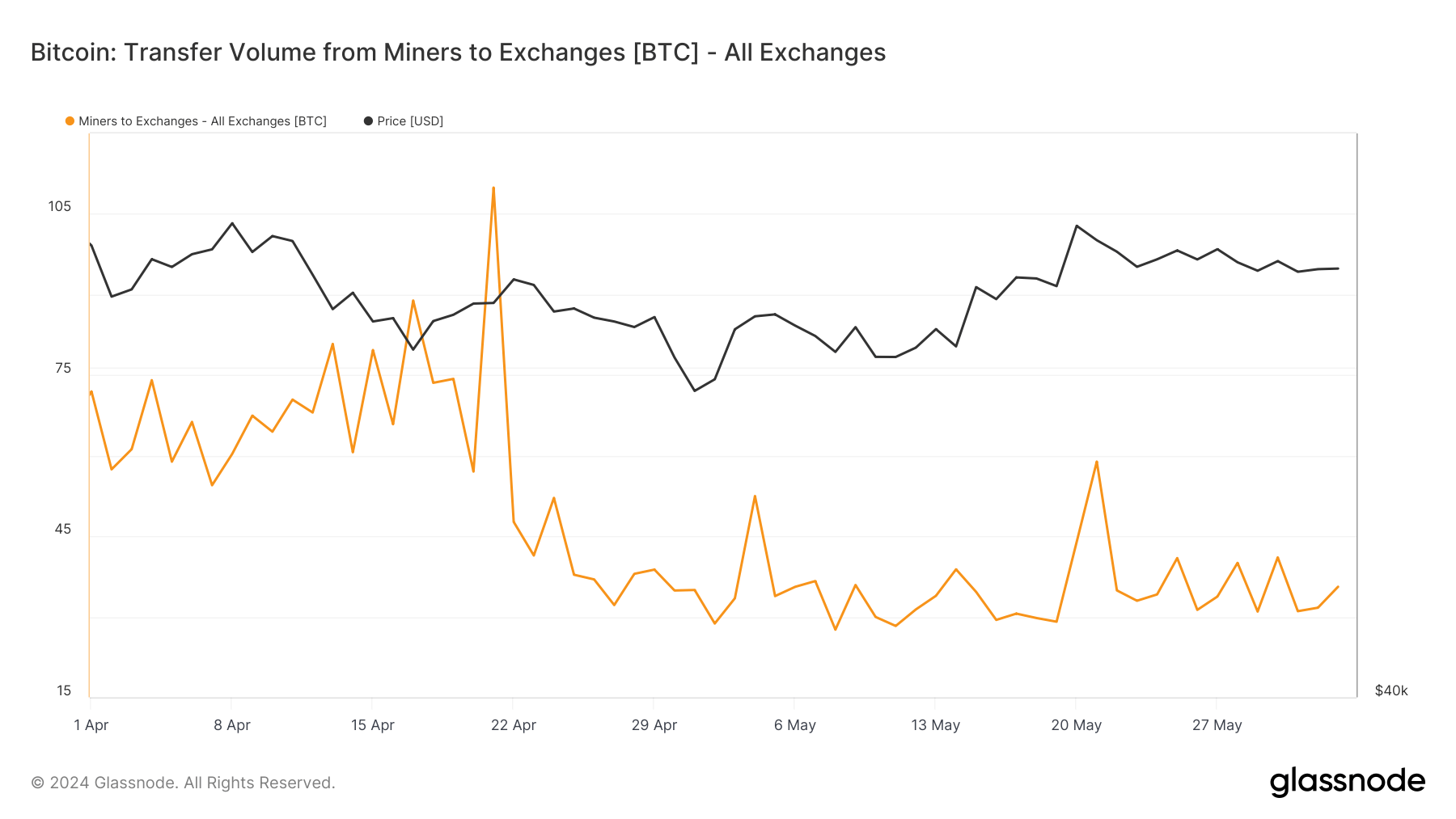

Analyzing miner transfers to exchanges further shows just how calm May was. Early April saw transfers of 71.95 BTC, which decreased to 57.03 BTC by April 20 and continued to decline, reaching 29.08 BTC by May 19. This metric remained relatively stable, with 34.90 BTC transferred by May 22 and 35.59 BTC by June 2. The reduced movement of BTC from miners to exchanges suggests that miners were not pressured to liquidate their holdings.

The net flow of coins into and out of miner addresses encapsulates the overall sentiment and activity. April’s net flows were highly volatile, peaking at 848.35 BTC on April 20 before plummeting to -748.18 BTC by April 22. May exhibited a more tempered dynamic, with a net inflow of 187.24 BTC on May 19, followed by a significant outflow of -2,007.13 BTC on May 22, and settling at -31.15 BTC by June 2. It suggests sporadic selling pressure but not at a level that indicates panic or a bearish outlook.

This contrasts with the volatility we saw in Bitcoin prices last month. While the market reacted to price fluctuations with typical volatility, miners adopted a more measured approach, potentially indicating confidence in the longer-term prospects of Bitcoin. This measured approach by miners could be interpreted as a sign of stability and maturation in the mining sector, where short-term price movements are less impactful on operational strategies.

Looking forward, the relative stability in miner balances and reduced transaction fees suggest that miners are likely anticipating a period of consolidation and are potentially gearing up for future price increases. The low levels of BTC transfers to exchanges indicate that miners are not under immediate financial pressure, allowing them to hold their assets and possibly benefit from higher prices down the line.

These metrics could also suggest that network activity and transaction volumes might remain subdued unless catalyzed by significant market events or technological developments. This could result in lower transaction fees and potentially reduced miner revenues unless offset by a substantial increase in Bitcoin’s price.

The post A flat month for miners after a volatile April appeared first on CryptoSlate.