Bitcoin Lightning Network Adoption Soars in Face of Bear Market

The Bitcoin Lightning Network has seen remarkable growth over the past two years despite the drawn-out crypto winter. Moreover, the findings have been published in a new report from Bitcoin technology and financial services company River.

On October 10, Bitcoin brokerage and custody services firm River released a research report on the growth of the layer-2 scaling solution Lightning.

Lightning Network Transactions Surge

River has measured Lightning Network growth in terms of transactions. It reported that there were at least 6.6 million routed Lightning Network transactions in August 2023. This represents a gain of 1,212% since August 2021, when there were 503,000 transactions.

The total volume was around $78 million, up over 500% from August 2021, it added.

“This growth was despite a 44% Bitcoin price drop and a 45% decrease in search interest.”

The primary use cases driving transaction growth are gaming, social media tipping, and streaming, driving 27% of all growth, it revealed.

The research also revealed that the average Lightning transaction size was around $11.84. Moreover, the size distribution shows most payments are too small to be affordable on the root Bitcoin blockchain.

“Lightning is effectively extending Bitcoin’s utility by enabling low-value payments over the Internet.”

River estimated there were between 279,000 and 1.1 million monthly active Lightning users as of September 2023.

Lightning activity has become much more global and distributed around the clock compared to last year, it stated.

Furthermore, the number of nodes, channels, and capacity have remained steady over the past year as nodes become more efficient. According to Bitcoinvisuals, the current LN capacity is 5,283 BTC, which is valued at around $146 million.

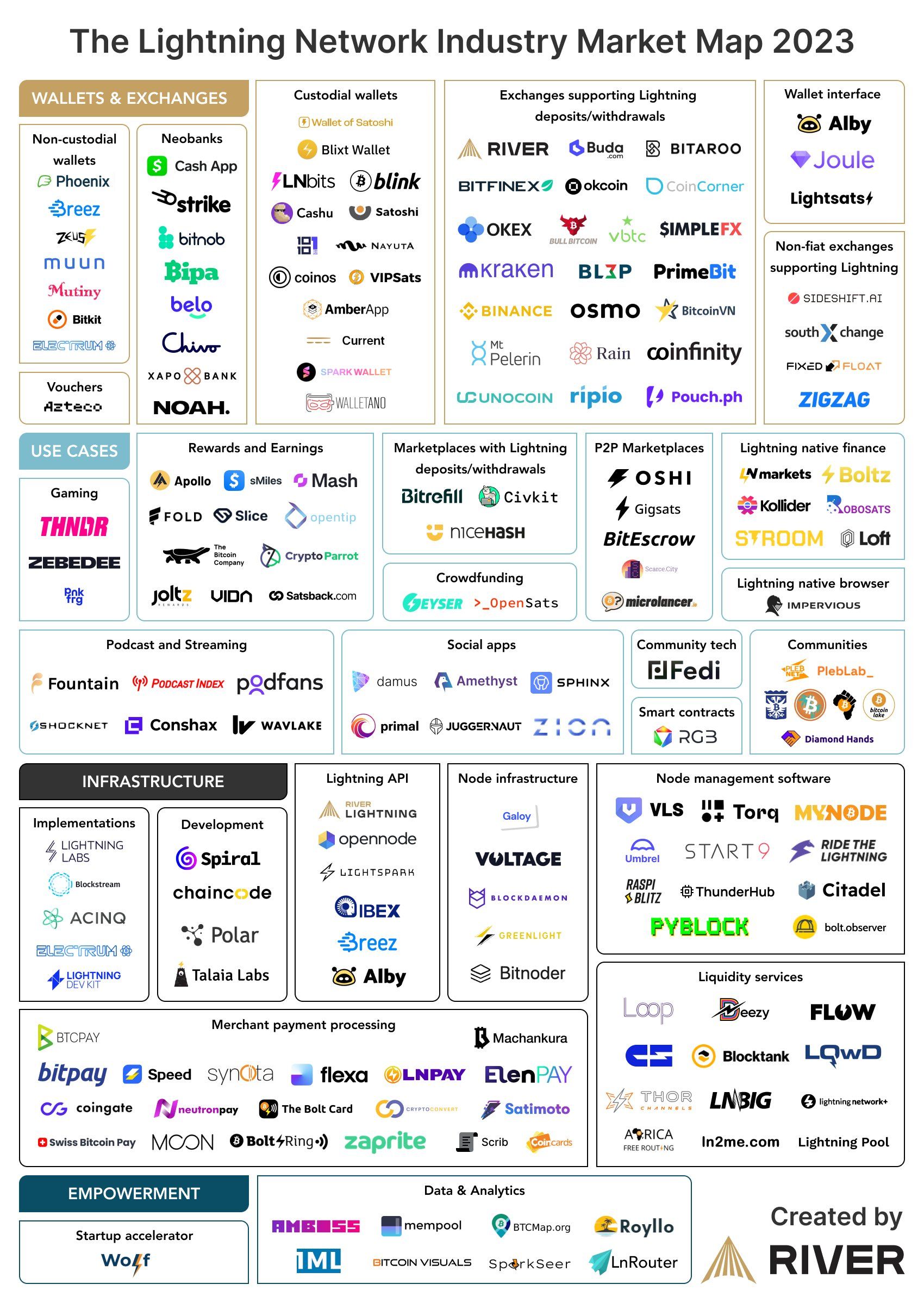

River reported that 173 companies have been identified across 28 Lightning industry categories, and the ecosystem is expanding.

Custodial Users Dominate

Sam Wouters, who complied the report, said,

“The ‘nobody is using Lightning’ meme is dead.”

He concluded that the real discussion is around non-custodial versus custodial LN usage. This refers to whether users hold their BTC or not.

The research revealed a ratio of non-custodial to custodial users of around 1:8. This means that most LN users are using exchanges or intermediary service providers. Wouters added:

“Making non-custodial usage as appealing as custodial wallets is a tough challenge, one that may require orders of magnitude more developers, companies, and capital to help figure out.”

In summary, key future growth drivers are more exchange adoption, select technical upgrades, and non-Bitcoin businesses adopting Lightning.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.