Bitcoin maintains price resilience despite increased miner selling

As the facilitators of the network’s security and transaction verification process, Bitcoin miners significantly influence the supply of BTC in the market.

This is why no market analysis can be complete without analyzing the changes in miners’ balances and activity. Firstly, changes in miner balance and activity provide insight into the sector’s economic health and operational stability. Secondly, miners’ decisions to sell or hold their BTC reflect their confidence in future value and can signal changes in market sentiment. Moreover, since miners are the primary source of new BTC entering the market, their selling and holding patterns can directly impact Bitcoin’s price volatility and liquidity.

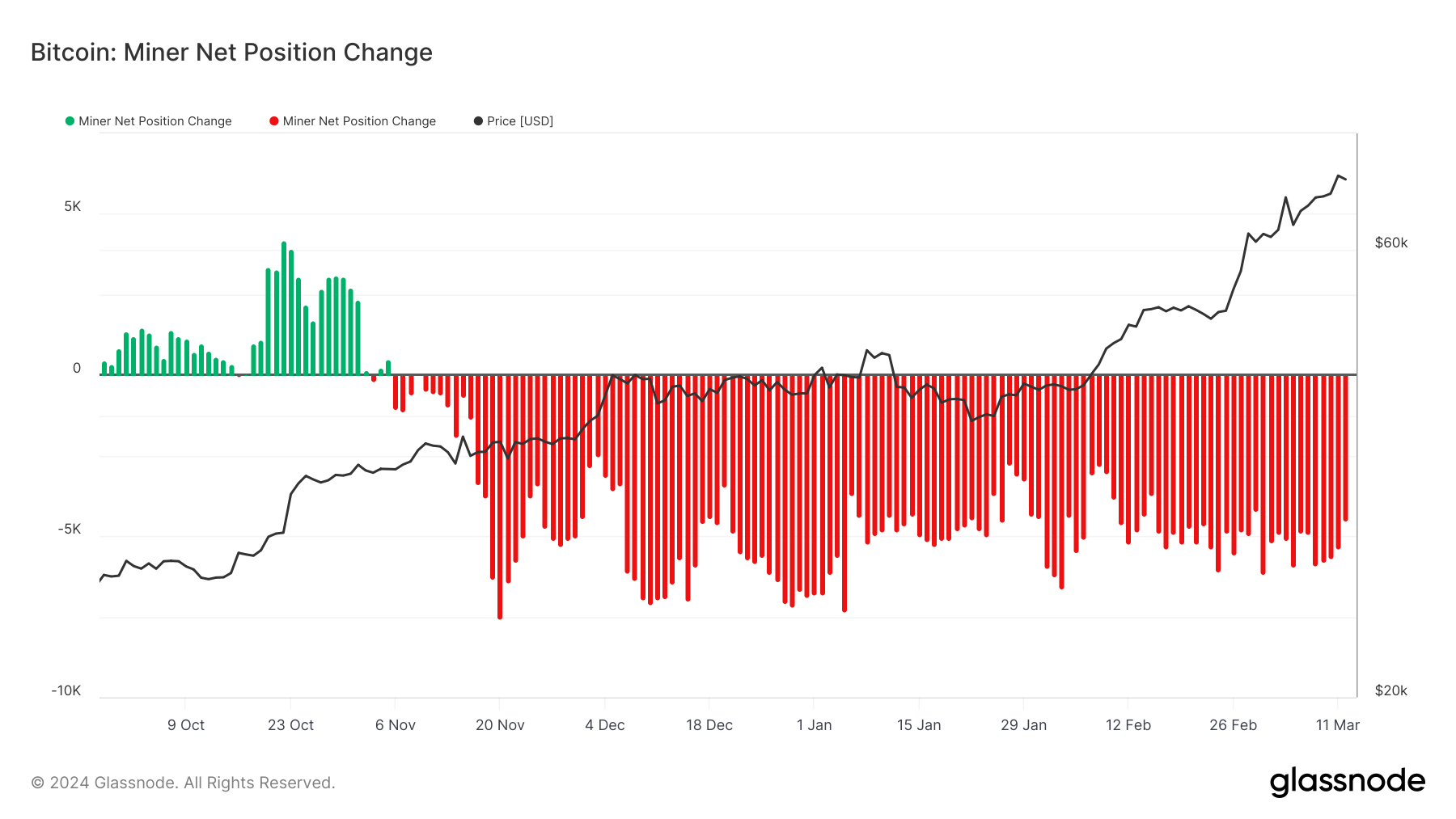

Data from Glassnode shows that there has been a gradual decline in the balance of BTC held in miner wallets since the fall of 2023. The balance decreased from 1.833 million BTC on Oct. 22, 2023, to 1.808 million BTC by Mar. 12.

Over 4,000 BTC left miner balances since the beginning of March. This decrease, which seems to have sped up significantly this month, shows consistent selling pressure from miners, who could be reducing their holdings to cover operational costs or capitalize on price increases.

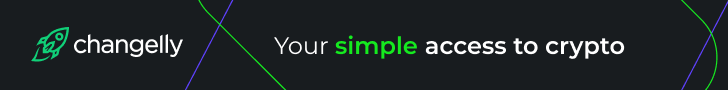

The net change in miner balances, which has been consistently negative since November 2023, shows the depth of this selling trend. The largest outflow of 7,310 BTC was recorded on Jan. 5, with another major outflow of 6,165 BTC seen on Mar. 1.

These outflows have preceded critical market events — the launch of spot Bitcoin ETFs in the US and the aggressive rally that pushed Bitcoin’s price above $70,000 — and show the miners have been anticipating major market movements.

Interestingly, despite the selling, the miner unspent supply — BTC that miners have mined but not yet sold — has shown relative stability, fluctuating slightly from 1.780 million BTC at the start of the year to 1.778 million BTC by Mar. 12. This suggests that while miners have been selling, the rate of new BTC mined and held is nearly balancing out the BTC sold.

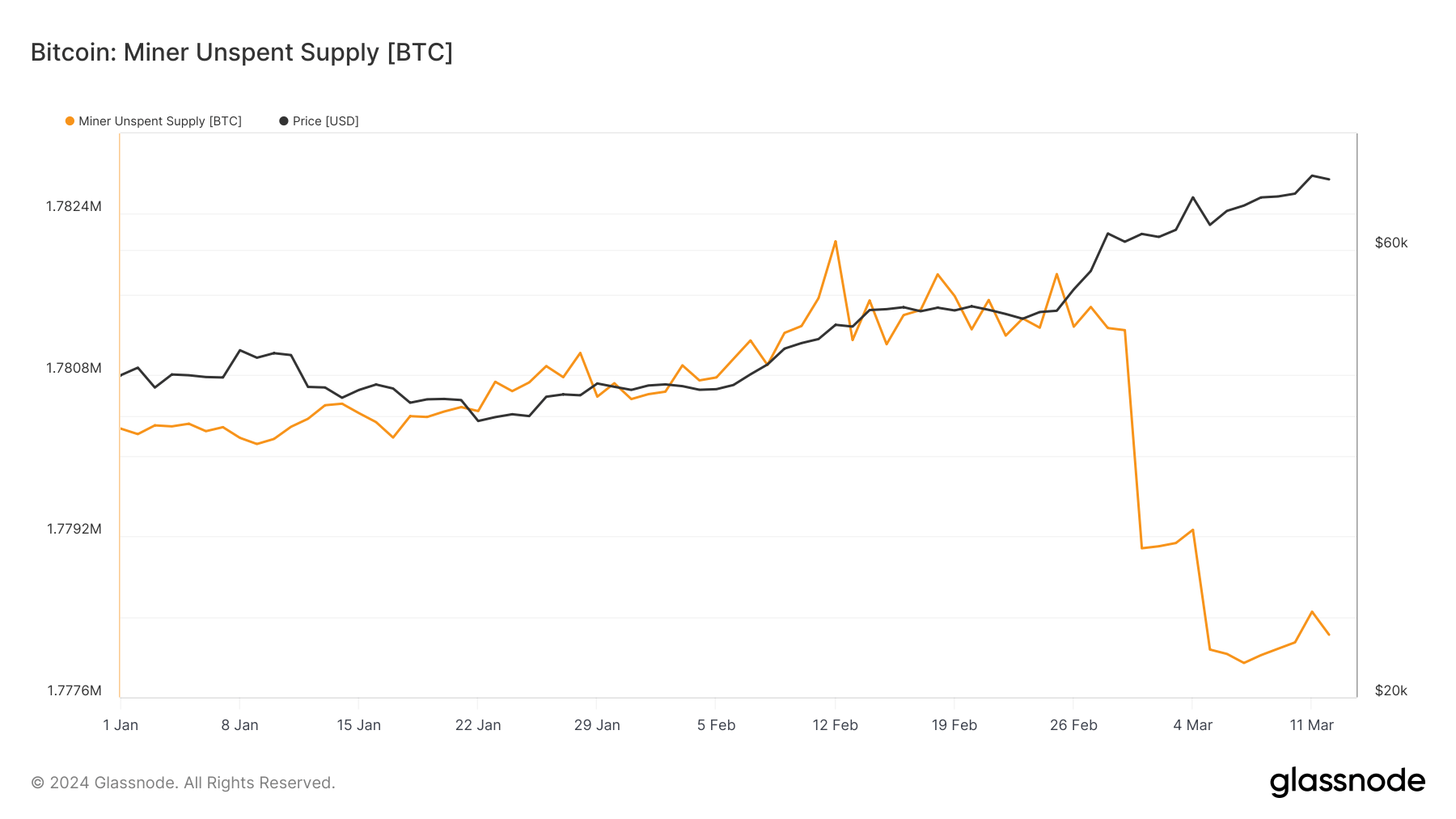

The transfer of coins from miners to exchange wallets, peaking notably around the launch of spot Bitcoin ETFs, shows miners capitalizing on opportunities or managing liquidity needs.

With transfers averaging between 67 BTC and 150 BTC in the first quarter of 2024 and a notable peak of 106 BTC on Mar. 12, it’s clear miners are actively managing their holdings, but not at a scale that suggests mass liquidation.

While Bitcoin miners have been net sellers for the last six months, the introduction and adoption of spot ETFs in the US have injected substantial liquidity and buying pressure into the market. The selling by miners, although significant, has been absorbed by the market without derailing the bullish momentum established since the start of the year.

The post Bitcoin maintains price resilience despite increased miner selling appeared first on CryptoSlate.