Cautious optimism in Bitcoin miner activity as accumulation tentatively continues

Bitcoin miners play a pivotal role in the cryptocurrency ecosystem. They validate transactions, secure the network, and circulate new Bitcoins. Their behavior, especially in holding or selling mined coins, can provide insight into market sentiment and future price movements.

Data from Glassnode has shown that there has been a negative net position change in miner balances in September. This means miners have been selling more Bitcoin than they’ve been mining. This could result from many different factors — miners might be selling BTC for USD or other fiat currencies to cover operational costs or take profits. Some might also be offloading their BTC in anticipation of a price slump.

However, despite the persistent negative net position change, the total miner balance hasn’t decreased this month. Miner balances have grown from 80,810 BTC on Sep. 1 to 81,760 BTC on Sep. 25. This uptick suggests that miners are offloading some of their holdings but aren’t parting ways with their newly minted coins. Instead, they’re still in accumulation mode, albeit at a potentially slower rate.

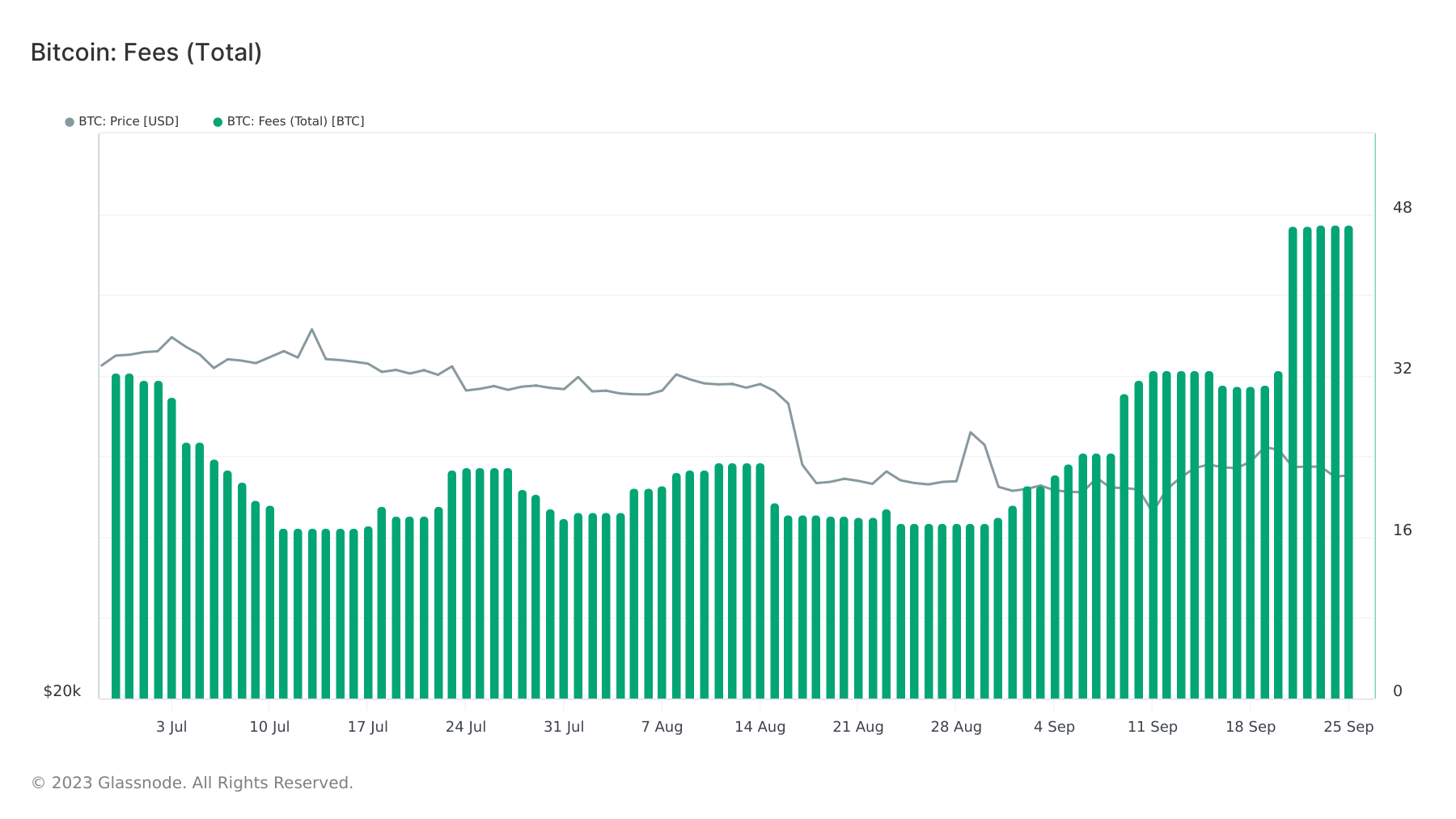

There has also been a notable increase in Bitcoin transaction fees this month, which jumped from 19 BTC on Sep. 1 to 46.9 BTC by Sep. 25. This uptrend points to heightened demand for transactions, possibly due to a bustling Inscriptions market or an influx of users. However, the spike in fees could also be attributed to network congestion, something the Inscriptions market has long been criticized for. A full Bitcoin mempool means many transactions are piling up, waiting to be included in a block, leading users to fork out higher fees to expedite their transaction confirmations.

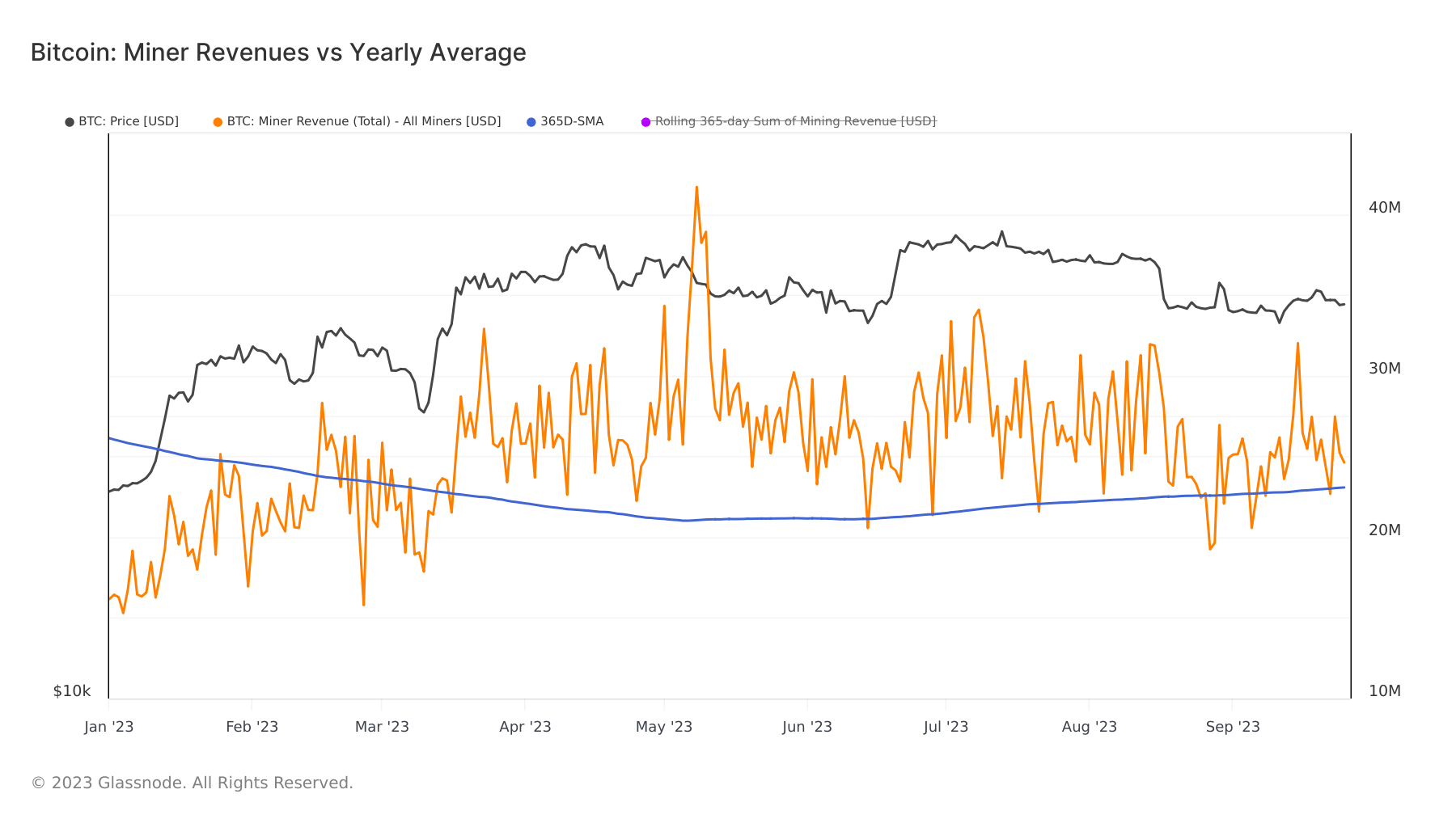

Comparing the current mining revenue with the yearly average indicates a favorable environment for miners. According to data from Glassnode, miner revenue has been above the yearly average for most of September. This is a continuation of a trend that began in March when the yearly average dropped below the current revenue after several months of divergence. This could be due to a combination of rising Bitcoin prices, the above-mentioned increased transaction fees, or both. This trend began in March and has since suggested sustained demand and activity in the Bitcoin network.

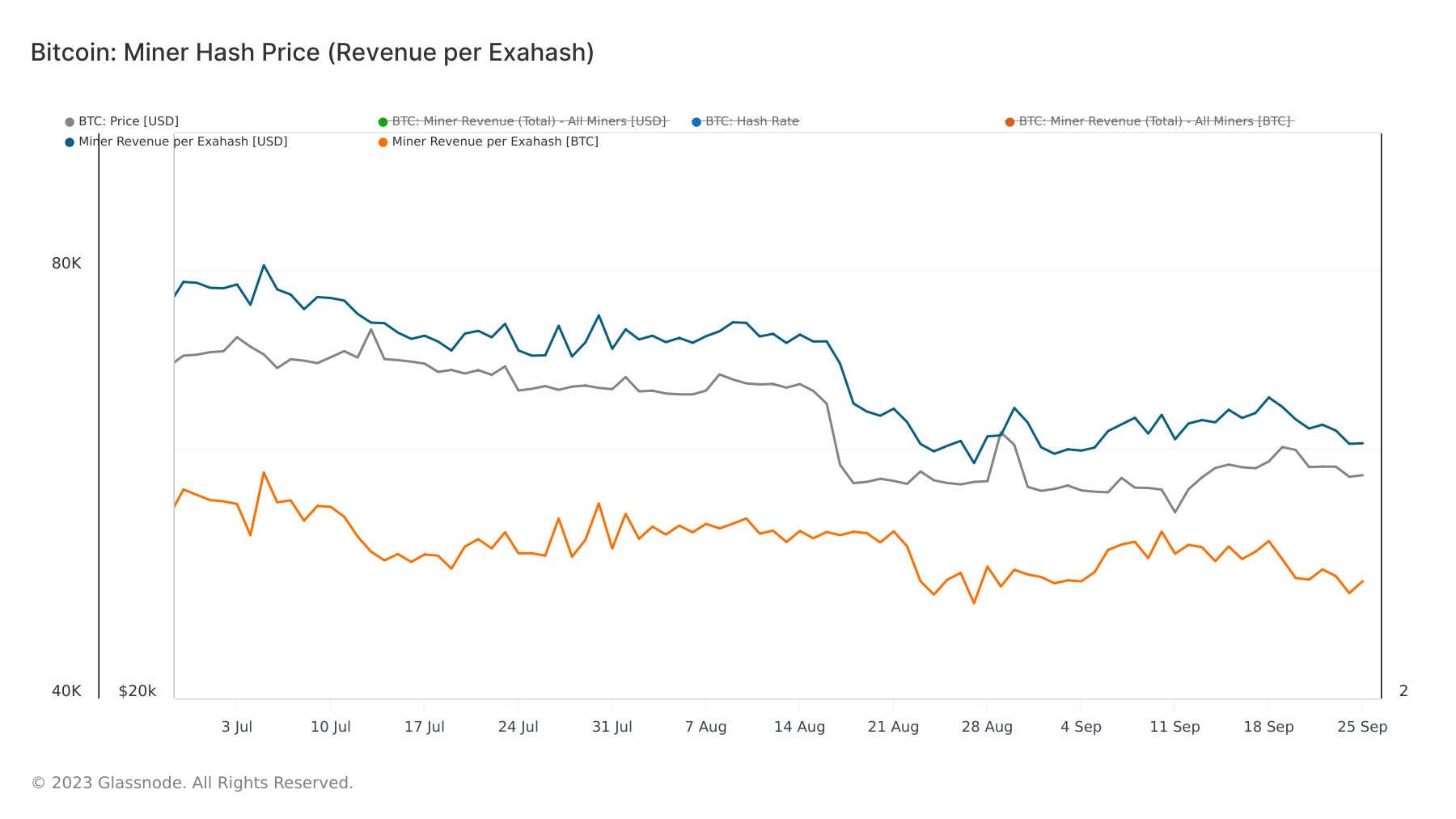

A closer examination of miner revenue per exahash reveals a slight dip in Bitcoin-denominated revenue, moving from 2.32 BTC to 2.30 BTC since the month’s inception. This suggests that miners are pocketing a tad less Bitcoin for every unit of computational effort. Potential culprits could be escalating competition among miners or minor network inefficiencies. However, when viewed through the lens of USD, the revenue per exahash has climbed from $60,120 on Sep. 1 to $60,505 on Sep. 25, signaling an appreciation in Bitcoin’s dollar value.

The sentiment in the Bitcoin market appears to be a blend of optimism and caution. Miners, while selling, continue to accumulate. The uptick in fees underscores a bustling network, and the sustained above-average miner revenue since March hints at a conducive environment for mining, potentially luring more miners to the fray. The dip in Bitcoin-denominated revenue per exahash raises eyebrows, but the uptick in its USD counterpart shows a positive increase in Bitcoin’s valuation.

The post Cautious optimism in Bitcoin miner activity as accumulation tentatively continues appeared first on CryptoSlate.