Post-halving congestion slashes Bitcoin active entities to levels unseen in three years

Onchain Highlights

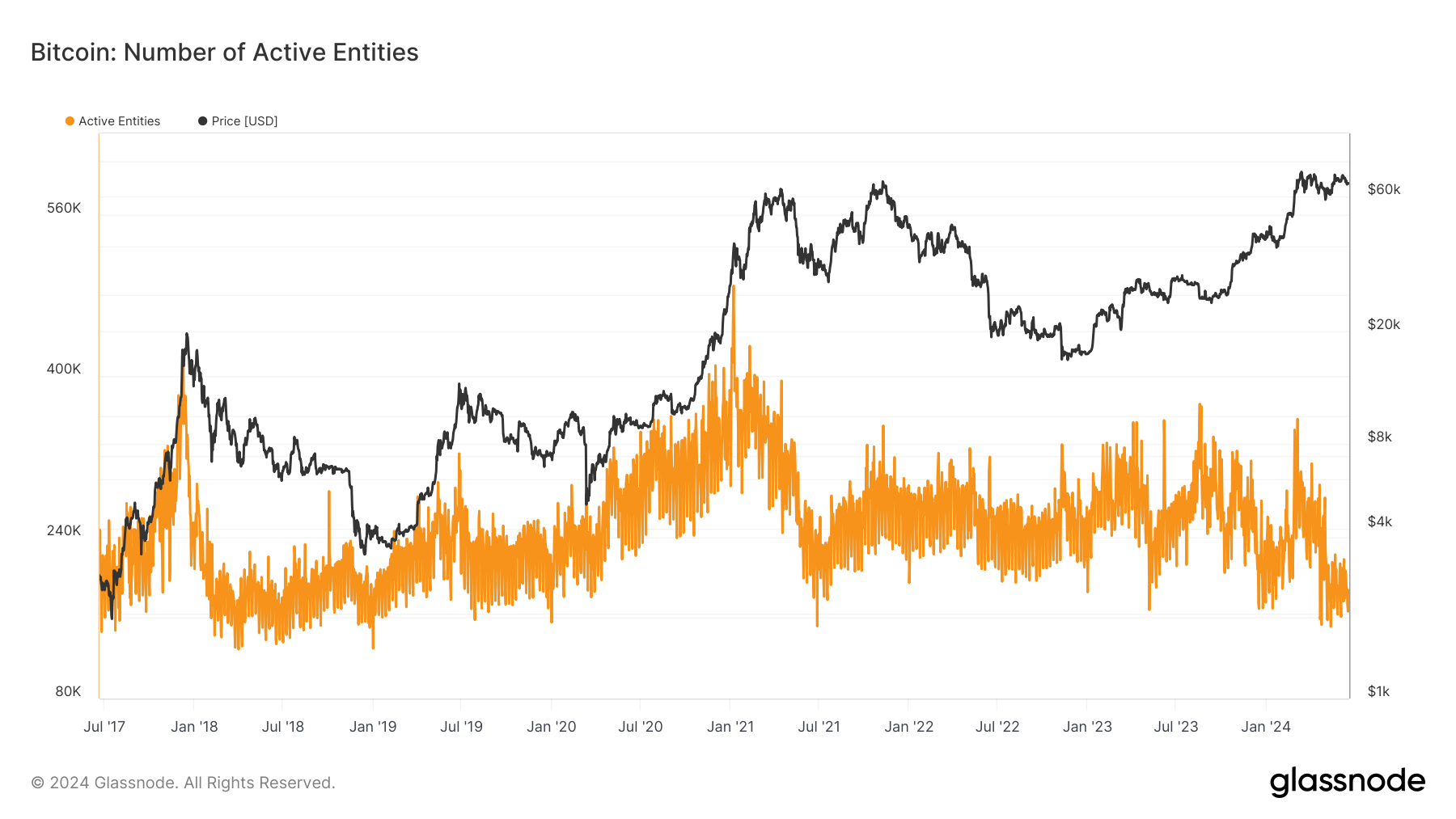

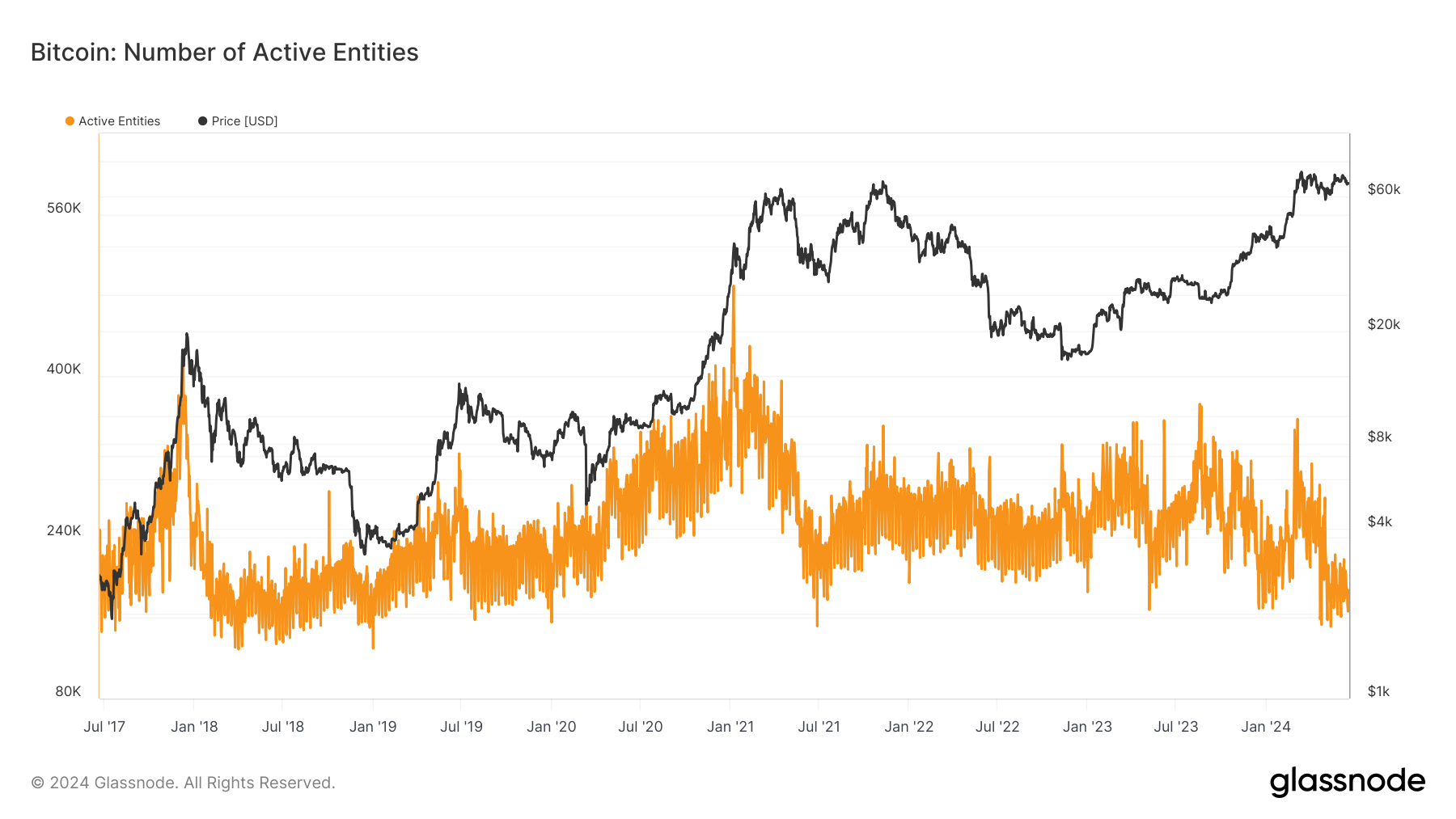

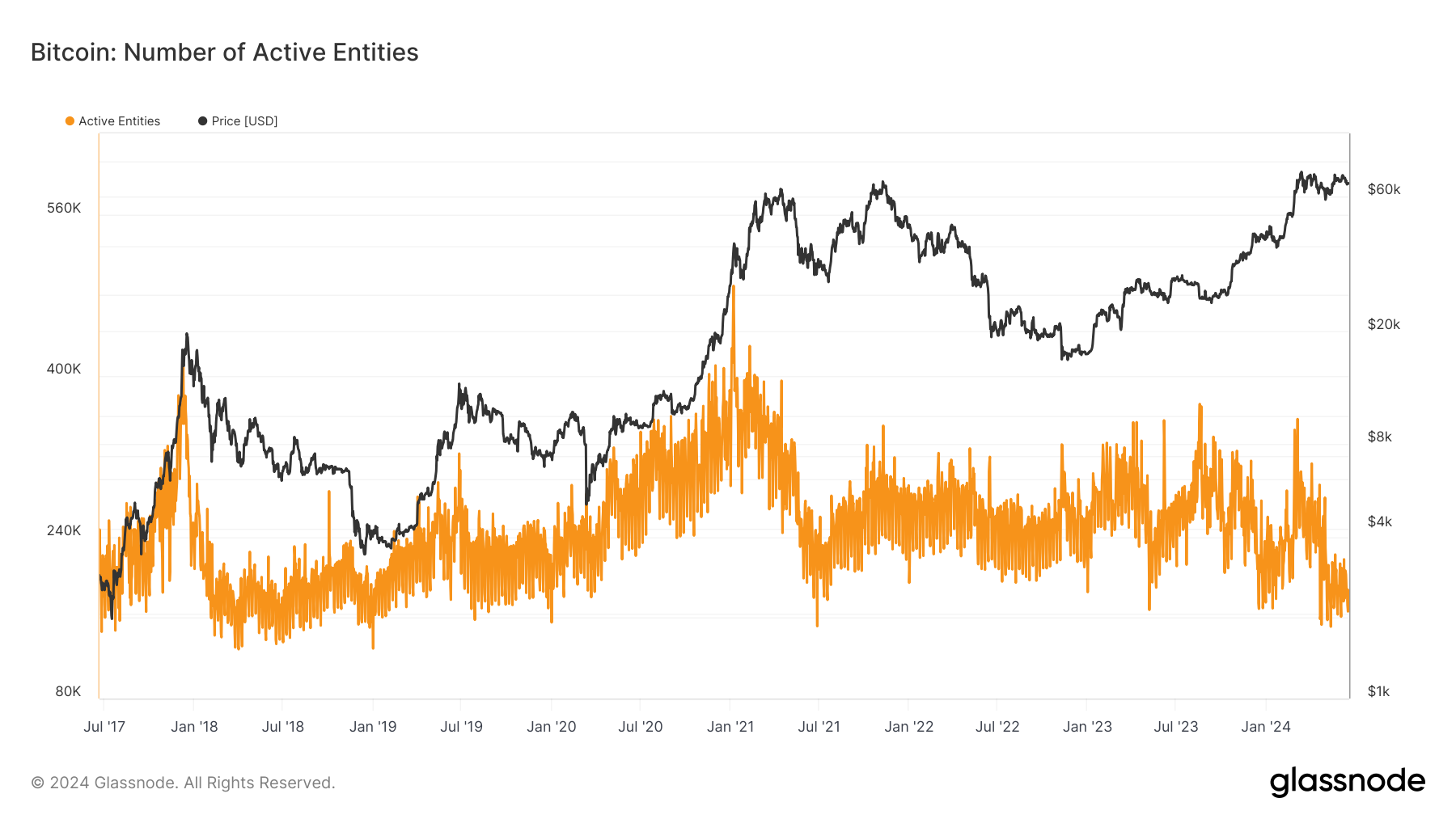

DEFINITION: The number of unique entities that were active either as a sender or receiver.

Bitcoin’s active entities have shown significant variability over recent months. Following the halving in April, the number of active addresses reached a three-year low, primarily due to a spike in transaction fees and network congestion. This surge in fees, driven by new protocols like Runes, has affected Bitcoin’s use for daily transactions.

Historically, active entity metrics have provided insights into market phases. For instance, during bear markets, a decline in active addresses typically signals reduced user engagement. Despite the current low in active entities, Bitcoin’s price has approached all-time highs, indicating market resilience.

The latest halving event notably influenced these trends. On the day of the halving, transaction fees surged to their highest level since December 2017, accounting for over 75% of miner revenue, which significantly impacted network activity. This trend suggests a complex interplay between transaction costs, network usage, and Bitcoin’s market behavior.