The U.S. Securities and Exchange Commission (SEC) has filed to dismiss its lawsuit against crypto firm Debt Box, after a federal judge threatened to sanction the regulator over “false and misleading” statements.

In a Tuesday court filing, the SEC requested that Judge Robert Shelby of the Northern Division District Court of Utah dismiss its lawsuit against Debt Box’s parent company Digital Licensing Inc. without prejudice.

In the filing, SEC lawyers wrote that, “While the Commission recognizes that its attorneys should have been more forthcoming with the Court, sanctions are not appropriate or necessary to address those issues,” adding that, “If the Court were to determine that some sanction is warranted, it should decline to impose a penalty beyond dismissal without prejudice.”

Dismissal without prejudice would enable the SEC to potentially refile charges against Debt Box at a later date.

In its lawsuit, the SEC alleged that Debt Box defrauded investors to the tune of nearly $50 million by selling unregistered securities. The regulator also obtained a restraining order against the Utah-based company, alleging that the firm “lied to investors about virtually every material aspect of their unregistered offering of securities, including by falsely stating that they were engaged in crypto asset mining.”

The SEC’s lawyers obtained an ex parte application, meaning that the firm couldn’t contest the restraining order in court.

In a December court order, U.S. District Judge Robert Shelby of the U.S. District Court in Utah expressed concern that the SEC had made “materially false and misleading” representations in the case, warning that the court could impose sanctions on the regulator.

The SEC noted in its filing on January 31 that it is “taking broader corrective action to ensure the concerns raised by the Court do not arise again,” including mandatory training on the “importance of candor.”

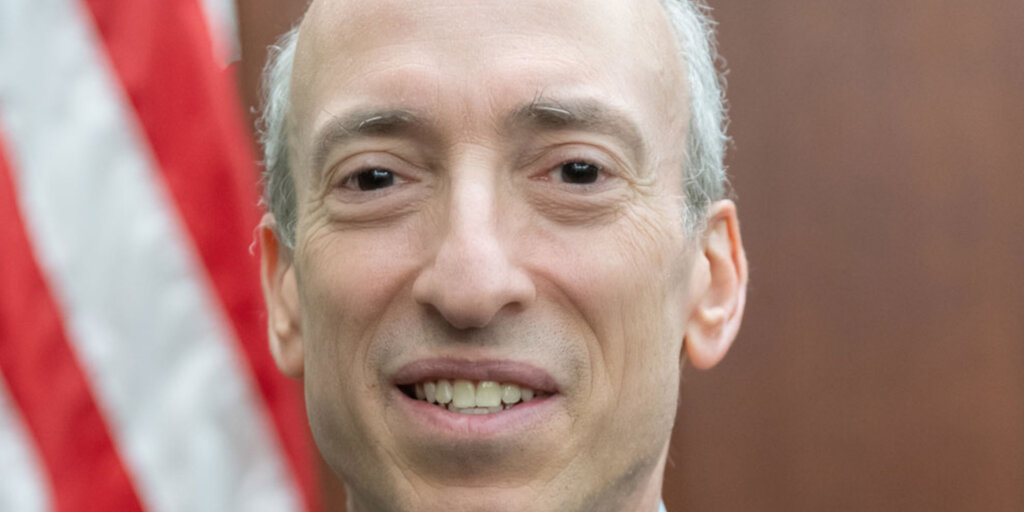

The SEC’s crypto enforcement actions

The regulator pursued over two dozen enforcement actions against crypto firms in 2023, a significant ramping-up over previous years, with SEC chair Gary Gensler alleging “rampand misconduct” in the industry. It has charged companies including Celsius, Kraken, Genesis and Gemini, and Nexo, with Kraken and Nexo paying civil penalties of $30 million and $22.5 million, respectively.

In June 2023, the regulator sued Coinbase over its staking service, alleging that the crypto exchange failed to register as an exchange, clearing house, and broker, and that it had sold unregistered securities via its staking service.

Earlier this month, U.S. District Judge Katherine Poll Failla questioned whether the regulator was “sweeping too broadly” in its application of securities laws, as lawyers for the SEC and Coinbase squared off in court.

Edited by Stacy Elliott.