Surging Bitcoin fees post-halving highlight new revenue dynamics for miners

Onchain Highlights

DEFINITION: Total transaction fess are the total amount of fees paid to miners. Issued (minted) coins are not included.

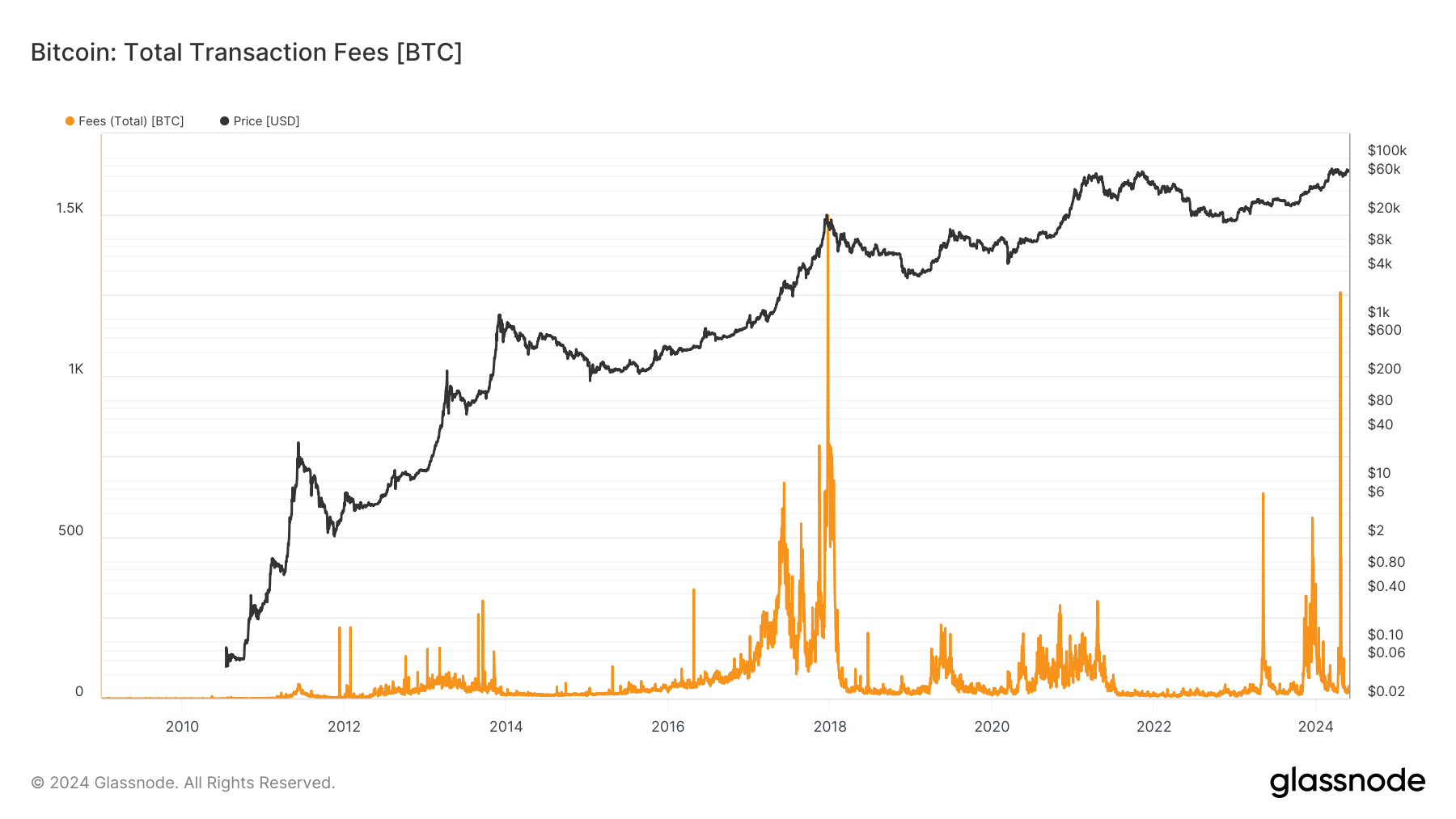

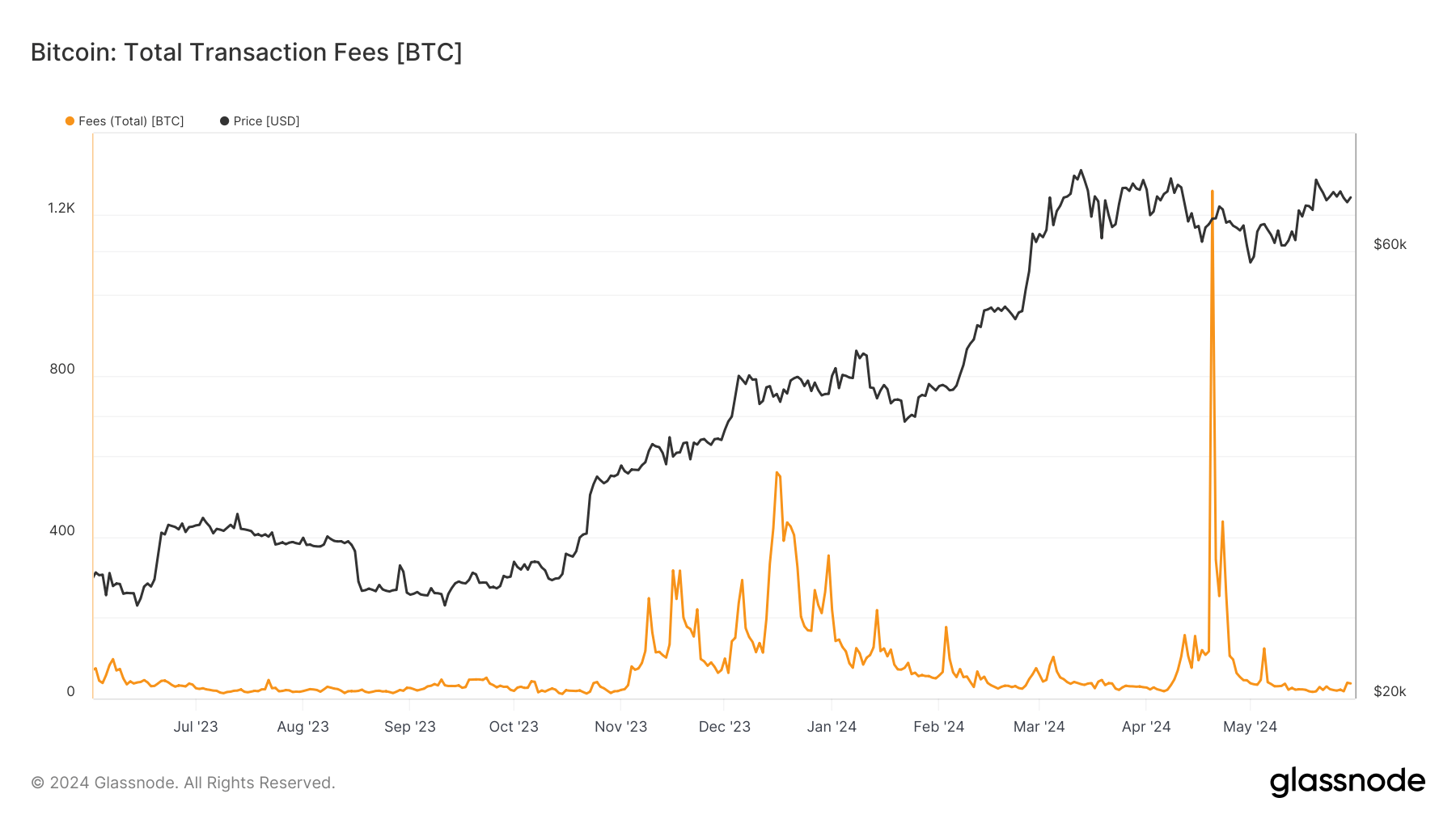

Bitcoin’s total transaction fees surged notably earlier in 2024. Following the halving event in April, fees have seen a marked increase, momentarily reaching record highs. This rise is largely attributed to the introduction of Runes, a new protocol, which significantly boosted network activity and congestion, resulting in a substantial uptick in transaction fees. On April 20, transaction fees peaked at 1,257.71 BTC, accounting for over 75% of miner revenue for the day.

Since then fees have subsided as Ordinals and Runes faded in popularity.

The elevated fees had various impacts on the Bitcoin ecosystem. For instance, the surge in fees has made Bitcoin transactions more costly, which in turn led to a decrease in active addresses on the network, reaching a three-year low. Despite this, the increase in transaction fees showcases the feasibility of a shift in miner revenue composition as a future reliance on fees for Bitcoin sustainability, which will inevitably be needed once all Bitcoin has been mined.

While fees recently dropped back to levels similar to mid-2023, a recent uptick has been observed, and any resurgence in Inscriptions popularity could see fees return to elevated levels.

As the year progresses, it will be crucial to observe how these fee conditions influence Bitcoin’s usability and miner profitability. The long-term effects of these changes will likely play a significant role in shaping the future of Bitcoin transactions and network participation.