Top Profitable Coins for Miners

The best crypto to mine are coins that balance profitability, network stability, and accessibility. With advancements in hardware and the rise of ASIC-resistant coins, mining has become more competitive, but there are still profitable opportunities for both small and large-scale miners.

In this guide, we break down the top 10 cryptocurrencies to mine and explain the key factors to consider before you start. We also provide insights into available mining methods, who they are best for, profitability, and long-term viability to help you determine which coins are worth mining.

Top Cryptocurrencies to Mine for Profit in 2026

CryptocurrencyMining Reward per BlockHardware RequirementMining DifficultyBest ForBitcoin (BTC)3.125 BTCASICVery HighExperienced miners with low electricity costsMonero (XMR)0.6 XMRCPU/GPUModerateBeginners and privacy-focused minersLitecoin (LTC)6.25 LTCASICHighMid-scale miners with Scrypt ASICsZcash (ZEC)1.5625 ZECGPUEasyGPU miners seeking privacy coinsDogecoin (DOGE)10,000 DOGEASIC (Scrypt)ModerateBeginners using merged mining with LitecoinDash (DASH)2.49 DASHASIC (X11)ModerateMiners targeting payment-focused coinsKaspa (KAS)3.46478289 KASGPU/ASICModerateHigh-speed blockchain enthusiastsVertcoin (VTC)12.5 VTCGPUEasyBeginners wanting ASIC-resistant miningRavencoin (RVN)2,500 RVNGPUEasyGPU miners looking for asset-focused coinsEthereum Classic (ETC)3.2 ETCGPUModerateMiners seeking PoW smart contract platforms

10 Best Cryptocurrencies to Mine in 2026

1. Bitcoin (BTC)

Bitcoin remains the most popular and valuable cryptocurrency to mine. It is the world’s first decentralized cryptocurrency, designed as a peer-to-peer digital currency that operates without central banks or intermediaries. As the first and most secure blockchain network, Bitcoin mining is the backbone of the entire crypto ecosystem.

That said, BTC mining today is different from it was in the early days. It’s no longer something you can do casually from a home computer. Mining Bitcoin is highly competitive and best suited for miners with access to specialized hardware, cheap electricity, and efficient cooling infrastructure.

- Mining difficulty: High. Bitcoin has the highest mining difficulty among cryptocurrencies. As more miners join and hash power increases, mining becomes harder, making it difficult for small-scale miners to compete without joining mining pools.

- Mining rewards per block: The current mining reward is 3.125 BTC per block, following the 2024 Bitcoin halving event.

- Hardware requirement: Bitcoin mining requires ASIC (Application-Specific Integrated Circuit) miners. GPUs and CPUs are no longer viable due to the network’s difficulty.

2. Monero (XMR)

![Monero [XMR]](https://images.surferseo.art/ebc91866-b16c-41f8-bcd0-b6f24e20a834.jpeg)

![Monero [XMR]](https://images.surferseo.art/ebc91866-b16c-41f8-bcd0-b6f24e20a834.jpeg)

Monero is one of the most popular cryptocurrencies for miners who value privacy and accessibility. Unlike BTC, Monero is designed to be private by default, with transactions that hide sender, receiver, and transaction amounts. This strong focus on privacy has helped Monero maintain steady demand and a loyal user base over the years.

For mining, Monero stands out because it’s intentionally built to resist ASIC mining. This keeps the network more decentralized and makes it far more accessible to everyday miners. Currently, Monero remains one of the best options for individuals who want to mine crypto without the massive upfront costs or the need for industrial-scale operations.

- Mining difficulty: Moderate. While difficulty has steadily increased over time, it is accessible, especially for solo miners and small mining pools.

- Mining rewards per block: Fixed reward of 0.6 XMR per block. Monero uses a tail emission model, which ensures continuous incentives for miners even after the main emission phase ended.

- Hardware requirement: Monero mining works best with CPUs, making it one of the most CPU-friendly cryptocurrencies available. Although GPUs can also be used with lower efficiency than CPUs. Monero mining is ASIC-resistant due to its RandomX algorithm, which is specifically optimized for general-purpose mining equipment.

3. Litecoin (LTC)

Litecoin was launched in 2011 to offer faster transaction times and lower fees than Bitcoin, while maintaining a strong focus on security and decentralization. Over the years, Litecoin has remained relevant largely because of its simplicity and reliability.

Additionally, it is widely supported by exchanges, wallets, and payment platforms, and it benefits from a long track record of uptime. For cryptocurrency miners, Litecoin offers a balance between network maturity and ongoing profitability, especially when combined with merged mining alongside Dogecoin.

- Mining difficulty: High. The difficulty has increased over the years as more miners and more powerful hardware have joined the network.

- Mining rewards per block: Litecoin’s block reward is 6.25 LTC per block, following its most recent halving in 2023.

- Hardware requirement: ASIC miners that support the Scrypt algorithm.

4. Zcash (ZEC)

Zcash is a privacy-focused cryptocurrency that allows users to make fully private transactions using zero-knowledge proofs. Unlike Monero, which enforces privacy by default, Zcash allows users to choose between transparent and shielded transactions. For miners, Zcash has long been considered a solid mid-tier option.

This is because Zcash is backed by a well-established project, has consistent network activity, and remains GPU-mineable in 2026. While it may not attract the same hype as newer projects, Zcash is the best coin to mine if you are looking for stability and predictable mining mechanics.

- Mining difficulty: Easy. Difficulty levels fluctuate based on network participation, but they are manageable for individual miners and small mining pools.

- Mining rewards per block: 1.5625 ZEC per block.

- Hardware requirement: Zcash mining is best suited for GPUs, particularly modern NVIDIA and AMD graphics cards. CPUs are inefficient, and ASICs are largely impractical for Zcash mining.

5. Dogecoin (DOGE)

Dogecoin is an open-source, peer-to-peer cryptocurrency launched as a lighthearted parody of Bitcoin. What keeps Dogecoin relevant is not only its meme culture, but also its fast transactions, low fees, strong community support, and utility.

DOGE is widely used for tipping, microtransactions, and everyday transfers, which helps sustain real on-chain activity. For mining, Dogecoin operates a merged-mining relationship with Litecoin. This means miners can earn DOGE and LTC simultaneously without using extra computing power. The merged mining setup improves profitability and reduces risk compared to mining a single coin.

- Mining difficulty: Moderate. Since DOGE is merge-mined with Litecoin, its difficulty closely tracks Litecoin network activity.

- Mining rewards per block: Dogecoin has a fixed block reward of 10,000 DOGE. Unlike BTC and Litecoin, Dogecoin does not have a maximum supply or halving events. This consistent reward structure provides steady incentives for miners and supports long-term network security.

- Hardware requirement: ASIC miners that support the Scrypt algorithm, the same algorithm used by Litecoin.

6. Dash (DASH)

Over time, Dash has evolved into a more balanced project that combines optional privacy features with instant transactions. What makes Dash unique from a mining perspective is its two-tier network. Miners secure the network and produce blocks, while masternodes handle governance and advanced features. This structure creates a more organized ecosystem and offers multiple ways for participants to earn rewards.

- Mining difficulty: Moderate. Dash’s mining difficulty adjusts to maintain an average block time of about 2.5 minutes.

- Mining rewards per block: Dash’s block reward is approximately 2.49 DASH per block. Unlike many networks, where miners receive the full reward, Dash splits block rewards among miners, masternodes, and the treasury.

- Hardware requirement: ASIC miners that support the X11 algorithm.

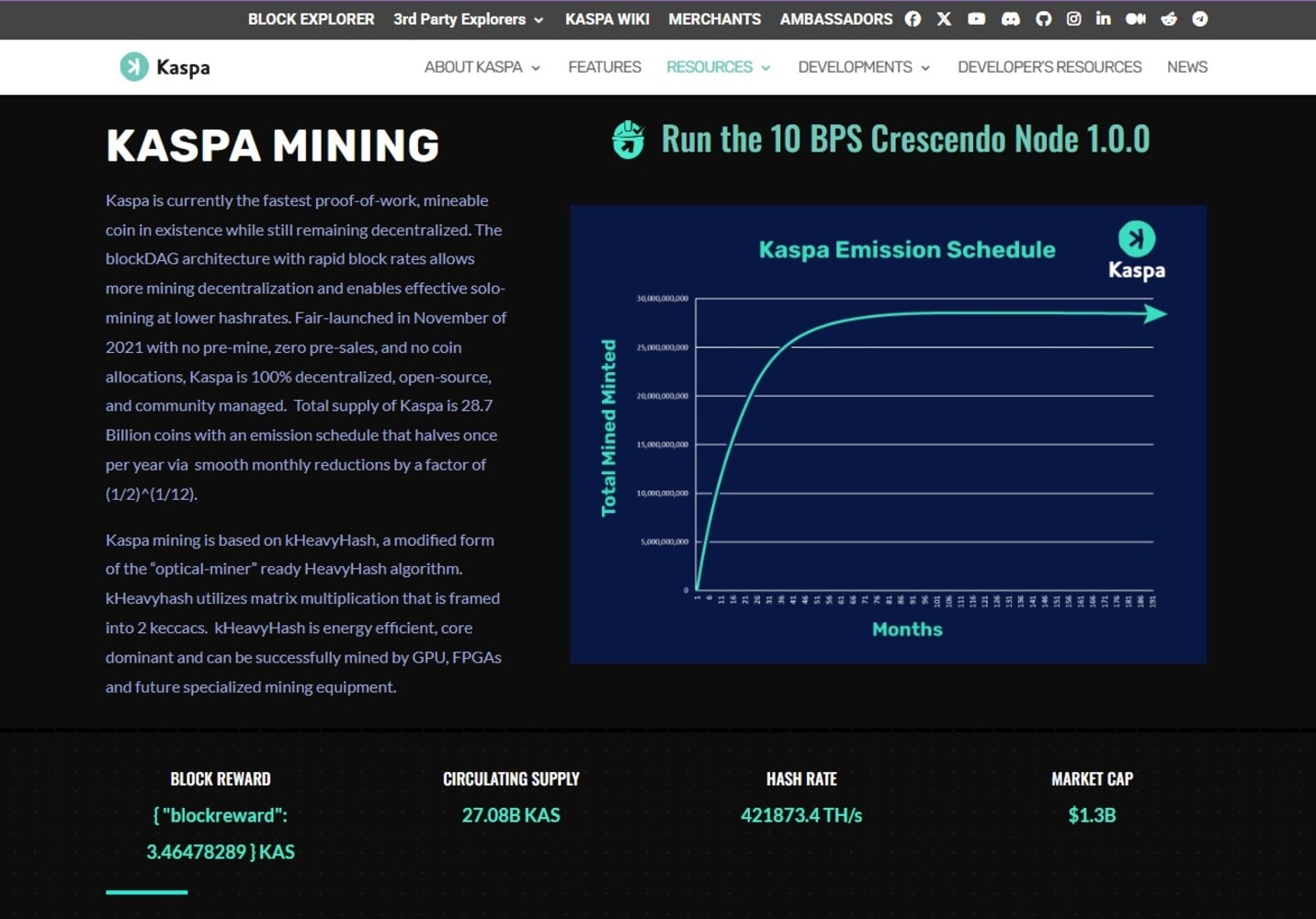

7. Kaspa (KAS)

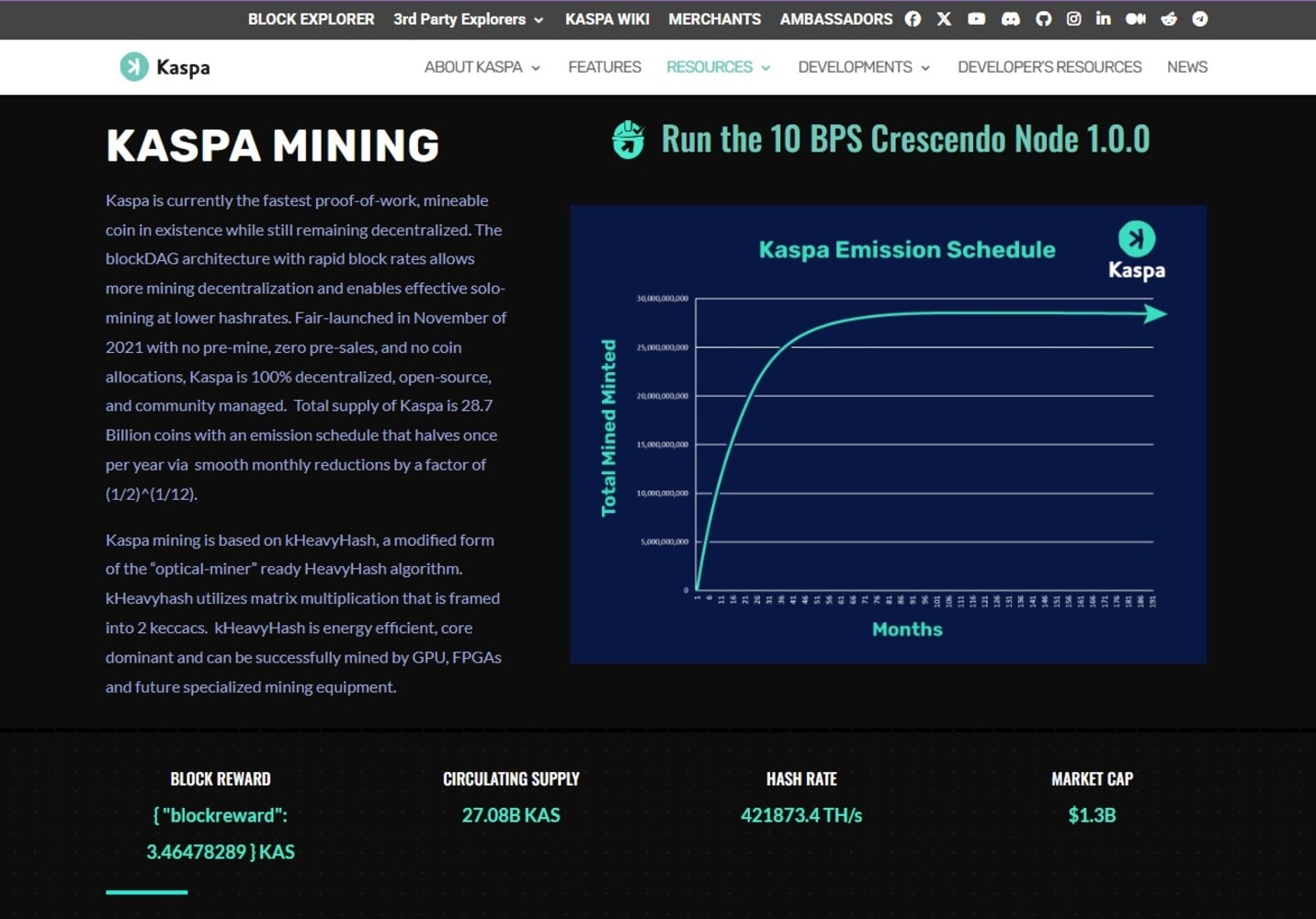

Kaspa is one of the fastest-growing proof-of-work cryptocurrencies in the market. It was built on a unique blockDAG (Directed Acyclic Graph) architecture to solve many of the speed and scalability issues found in traditional blockchains. Instead of producing one block at a time, Kaspa allows multiple blocks to be created and confirmed in parallel, resulting in extremely fast transaction confirmation times.

- Mining difficulty: Moderate. Kaspa’s mining difficulty adjusts quickly in response to changes in network hash rate.

- Mining rewards per block: 77.78 KAS. Kaspa uses a smooth emission schedule rather than abrupt halving events. Currently, miners earn a gradually decreasing KAS reward per block, with emissions reducing monthly. This creates a more predictable reward curve and avoids sudden shocks to miner profitability.

- Hardware requirement: Kaspa can be mined with GPUs, particularly high-end NVIDIA and AMD cards optimized for the kHeavyHash algorithm. However, ASIC miners for Kaspa have entered the market, significantly increasing network hash power.

8. Vertcoin (VTC)

Vertcoin is a community-driven cryptocurrency created with one clear goal: keep mining decentralized and accessible to everyday users. I was designed to prevent large mining farms from dominating the network. This philosophy has helped Vertcoin maintain a loyal following, even as many other proof-of-work projects shifted toward expensive ASIC-hardware.

- Mining difficulty: Easy. Vertcoin is one of the easiest and cheapest crypto to mine. Its difficulty levels are relatively low compared to major PoW networks, making it suitable for solo miners and small mining setups.

- Mining rewards per block: Vertcoin offers a block reward of 12.5 VTC.

- Hardware requirement: Vertcoin is best mined with GPUs. It uses the Verthash algorithm, which is specifically designed to resist ASICs and favor consumer-grade graphics cards.

9. Ravencoin (RVN)

Ravencoin is a proof-of-work blockchain built specifically for asset creation and transfer. Unlike general-purpose networks, Ravencoin focuses on enabling users to issue tokens that represent real-world or digital assets, such as securities, NFTs, or in-game items.

For mining, Ravencoin has long been favored by GPU miners. The network is strongly ASIC-resistant, making it a go-to option for miners who want fair competition and don’t want to invest in expensive, energy-efficient hardware.

- Mining difficulty: Easy. Difficulty fluctuates with network participation but remains more accessible for individual miners and smaller mining pools than in ASIC-dominated networks.

- Mining rewards per block: Ravencoin offers a block reward of 2,500 RVN per block.

- Hardware requirement: Ravencoin mining is best suited for GPUs, particularly NVIDIA and AMD graphics cards. The KAWPOW algorithm is designed to resist ASICs and discourage FPGA dominance, keeping mining accessible to home miners.

10. Ethereum Classic (ETC)

Ethereum Classic (ETC) is the original Ethereum blockchain that continued after the 2016 hard fork following the DAO hack. While Ethereum itself moved to proof-of-stake, Ethereum Classic has remained a proof-of-work network, keeping mining alive and accessible. ETC appeals to miners seeking exposure to an Ethereum-like network without staking requirements, and it remains compatible with many Ethereum-based tools and smart contracts.

- Mining difficulty: Moderate. While difficulty has increased as more miners join the network, it remains lower than Ethereum’s former PoW algorithm, keeping ETC mining feasible for small and mid-sized operations.

- Mining rewards per block: Ethereum Classic miners receive 3.2 ETC per block, plus transaction fees.

- Hardware requirement: Ethereum Classic is best mined with GPUs, particularly modern NVIDIA and AMD cards optimized for the Etchash algorithm. ASIC miners for ETC exist but are less common due to Etchash’s memory-hard design.

What Is Cryptocurrency Mining?

Crypto mining is the process by which powerful computers validate crypto transactions and add them to a secure public ledger (blockchain). Miners compete with powerful computers to solve complex mathematical puzzles, securing the network and earning new coins as rewards. Mining serves two main purposes:

- Transaction validation: Every time someone sends or receives crypto, miners confirm that the transaction is legitimate, preventing double-spending or fraud.

- Coin creation: Mining introduces new coins into circulation. For instance, Bitcoin miners earn BTC for each block they successfully mine, and the same holds for altcoins that support mining.

Mining requires specialized mining equipment, mining software, electricity, a cryptocurrency wallet, and often pool participation to share rewards. As highlighted above, the type of hardware depends on the cryptocurrency being mined. We discuss the various mining methods/hardware available below:

Types of Mining Methods

1. ASIC Mining

ASICs, or Application-Specific Integrated Circuits, are custom chips optimized for one algorithm, like Bitcoin’s SHA-256. These miners deliver top hash rates and are highly efficient. ASICs are incredibly powerful and dominate networks like BTC and Litecoin, but they are expensive and inflexible because they can only mine a single coin.

2. CPU Mining

CPU mining relies on a computer’s central processing unit to perform mining calculations. This method was common in the early days of crypto but is now mostly limited to ASIC-resistant coins ot those with low network difficulty, like Monero. CPUs are widely available and easy to use, but they are much slower and less profitable compared to GPUs or ASICs.

3. GPU Mining

GPU mining uses graphics cards to perform parallel hashing for coins like Ethereum Classic or Ravencoin. These miners balance cost, accessibility, and performance better than CPUs. Many modern miners prefer GPUs because they are more versatile than ASICs and can mine a wide range of coins.

4. Phone Mining

Phone mining allows users to mine cryptocurrency on mobile devices. While it’s technically possible, mining on phones is extremely slow and produces very little profit. It is mostly used for learning or small, low-difficulty coins, rather than for serious mining operations.

How to Choose the Best Cryptocurrency to Mine

Choosing the right crypto to mine goes beyond the popularity of the coin. You need to match any crypto asset you are mining to your goals and available resources. Start by assessing the coin’s profit potential. Some coins give high rewards but require massive investment and advanced hardware, while others have smaller rewards but are easier to access for beginners.

Also consider network structure, the team behind it, and community support. Coins with strong developer teams and active communities are more likely to maintain value over time, reducing the risk of mining a coin that becomes obsolete.

Finally, think about flexibility and accessibility. Some coins allow GPU or CPU mining, making them easier for hobby miners. Others require ASICs or specialized rigs, which may only make sense if you plan large-scale mining operations.

Key Factors to Consider Before You Start Mining

The main factors to consider before you start mining include mining difficulty, rewards and transaction fees, hardware requirements, profitability, and accessibility.

- Mining difficulty: Consider how hard it is to solve blocks on a chain. High-difficulty coins like BTC require expensive ASICs and lots of electricity, while lower-difficulty coins like Monero or Ravencoin are more accessible to GPU or CPU miners.

- Block rewards and transaction fees: Higher rewards per block and transaction fees can boost earnings, but they often come with more competition. Coins like Dogecoin and Vertcoin offer consistent rewards with lower hardware demands.

- Hardware requirements: Check what type of mining hardware the coin requires. ASICs are powerful but costly and inflexible, while GPUs and CPUs are more versatile but may generate lower output. Factor in cooling and electricity costs as well.

- Long-term viability: Choose coins with strong communities, active development, and real-world adoption. Coins with clear use cases or privacy features, such as Monero or Kaspa, often offer more stable long-term profitability.

- Profitability and accessibility: Balance potential earnings against how easy it is for you to mine the coin given your existing setup, budget, and technical experience.

- Mining pools: Joining a pool allows miners to combine computing power, making rewards more consistent and predictable, especially for coins with high difficulty. While pool rewards are shared, this reduces the uncertainty of solo mining.

Conclusion: Is Crypto Mining Still Profitable in 2026?

Crypto mining is still profitable in 2026. However, knowing the most profitable crypto to mine depends on several factors. Some of which include selecting the coin, using efficient hardware, and managing electricity and maintenance costs. Mining pools reduce risks and can improve the consistency of the rewards you receive, while solo mining carries a higher risk.

If you’re new, coins with lower difficulty or GPU-friendly algorithms like Monero and Ravencoin offer easier entry, but high-demand networks like Bitcoin or Ethereum Classic require significant investment. So before opting for any coin, consider the factors highlighted above and how they match your mining goals.

FAQs

What is the most profitable crypto to mine?

Bitcoin remains the most profitable cryptocurrency to mine in 2026 for those with efficient ASICs and access to cheap electricity. For GPU or CPU setups common among small miners, alternatives like Ravencoin (RVN) or Ethereum Classic (ETC) offer good returns due to lower barriers to entry and ASIC resistance.

Is it still profitable to mine Bitcoin?

Yes, mining BTC can still be profitable in 2026, but only for miners with efficient ASIC hardware and access to low-cost electricity. Solo mining is challenging due to high difficulty, so most miners join mining pools to receive consistent rewards.

What’s the easiest coin to mine for beginners?

Coins that are GPU- or CPU-friendly, with lower network difficulty, are easiest for beginners. Examples include Monero, Vertcoin, and Ravencoin. These coins allow smaller miners to participate without expensive ASICs while still earning block rewards.