Trump-backed American Bitcoin discloses holding $273M in BTC on Nasdaq debut, stock jumps 72%

Key Takeaways

- American Bitcoin has debuted on Nasdaq with the ticker ABTC after merging with Gryphon Digital Mining.

- The company focuses on Bitcoin accumulation through self-mining and strategic partnerships like Hut 8.

Share this article

American Bitcoin Corporation, backed by President Trump’s sons and Hut 8, officially made its debut on Nasdaq on Wednesday after merging with Gryphon Digital Mining in a stock-for-stock deal.

Trading on Nasdaq as ABTC, American Bitcoin functions as a Bitcoin accumulation platform aimed at advancing US crypto infrastructure. According to a Sept. 3 SEC filing, the company holds 2,443 BTC, valued at nearly $273 million, up from 152 BTC in its first disclosure.

American Bitcoin plans to sell up to $2.1 billion of Class A common stock and use the net proceeds to purchase Bitcoin, acquire Bitcoin mining ASICs, and for general corporate purposes, a separate filing shows.

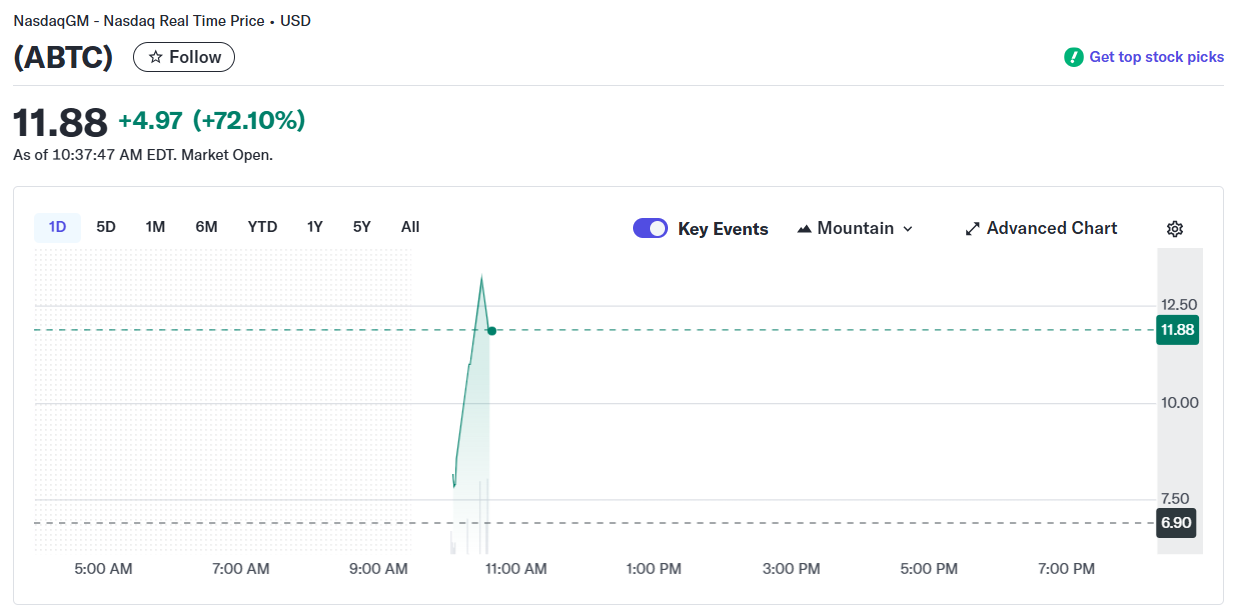

The company’s stock jumped about 72% in early trading today, according to Yahoo Finance data.

Co-founder Eric Trump said in a statement that the company serves as a top public vehicle for investors seeking Bitcoin exposure. He called Bitcoin “the defining asset class of our time.”

“Our Nasdaq debut marks a historic milestone in bringing Bitcoin into the core of U.S. capital markets and advancing our mission to make America the undisputed leader of the global Bitcoin economy,” Trump stated.

Commenting on the move, Donald Trump Jr., also a major backer of American Bitcoin, said the company’s Nasdaq debut reflects its mission of promoting values like freedom and transparency while giving investors exposure to Bitcoin as part of strengthening the US economy.

“American Bitcoin embodies the values that define American strength: freedom, transparency, and independence,” said Trump Jr. “With our Nasdaq listing, we are elevating this mission onto the global stage, giving investors a vehicle we believe will strengthen the US financial system and help build a more resilient national economy.”

The company employs a dual accumulation strategy combining self-mining operations and opportunistic Bitcoin purchases. Through its partnership with Hut 8, American Bitcoin utilizes next-generation ASIC technology and leverages Hut 8’s colocation infrastructure platform for mining operations.

Asher Genoot, executive chairman of American Bitcoin and CEO of Hut 8, said the Nasdaq debut positions the company to become a leader in Bitcoin accumulation, leveraging mining, market purchases, and Hut 8’s infrastructure to boost Bitcoin-per-share growth.

Share this article

The post Trump-backed American Bitcoin discloses holding $273M in BTC on Nasdaq debut, stock jumps 72% appeared first on Tokention.