Bitcoin mining giants lose $2.8B in market cap to crypto market’s sudden crash

The top five largest crypto mining companies collectively lost $2.8 billion of their market Cap following last Thursday’s Bitcoin (BTC) flash crash.

AltIndex data reveals a 30% decline over the past month among the prominent BTC miners. This group, consisting of Riot Blockchain, Marathon Digital Holdings, Canaan Inc., Hut 8 Mining, and Cipher Mining Technologies, saw their combined market capitalization drop to approximately $6.7 billion from the $9.5 billion recorded in July.

Hut 8 and Cipher experienced the most significant percentage decline, losing 32%, equivalent to over $400 million of their market capitalization, respectively. Meanwhile, Riot Blockchain led the losses in terms of monetary value, with its 31% drop equaling $1.08 billion.

Marathon Digital Holdings, the world’s second-largest crypto miner, wasn’t spared either, as it saw a 25% decrease, resulting in a $790 million market cap loss. Additionally, Canaan Inc. observed a 16% drop, reducing its valuation to $460 million.

Mining revenue rises

Despite the crypto-mining companies’ decreasing market capitalization, AltIndex noted a consistent rise in miners’ revenue.

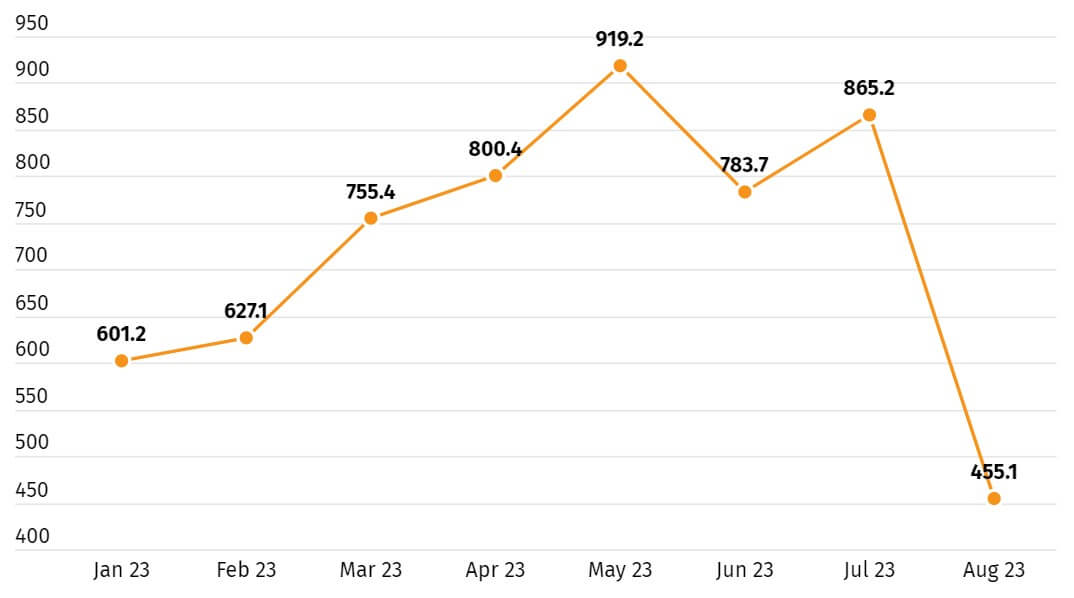

AltIndex, citing TheBlock data, reported a substantial 43% increase in miner revenue from the beginning of the year. The report underscores an impressive ascent, with miners’ earnings climbing from $601.2 million in January to $856 million in July.

This upward trajectory was not without its fluctuations. In the initial four months of the year, miner earnings exhibited steady growth, culminating in a peak of $920 million in May. However, this peak was followed by a dip to $783.7 million in June. Remarkably, July marked a resurgence, with earnings surging back to $856 million. This positive momentum has continued unabated into the current month, with miner revenue already exceeding $455 million.

Bitcoin mining difficulty climbs to ATH.

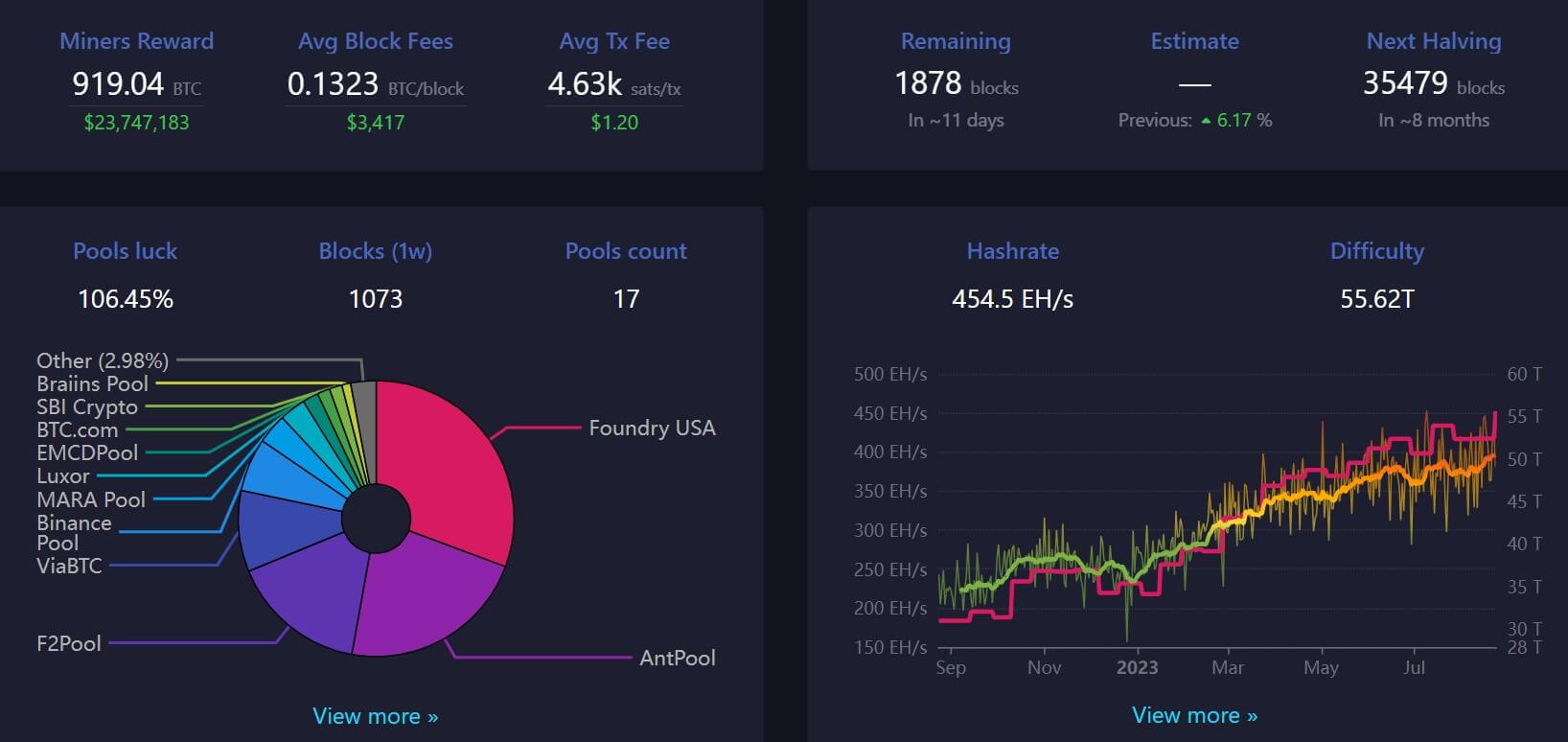

On Aug. 22, Bitcoin mining difficulty surged by 6.17% to reach an unprecedented high of 55.62 trillion hashes, according to mempool.space data. This difficulty increase is coming on the heels of Bitcoin rising to an all-time high of more than 400 trillion hashes per second (Th/s) for the first time during the past week.

CryptoSlate Insight reported that the surging numbers highlight the significant uptick in miners’ hash rates, signaling a potential end of miners’ capitulation.

The post Bitcoin mining giants lose $2.8B in market cap to crypto market’s sudden crash appeared first on CryptoSlate.